The most common method of valuing commercial property is the least accurate, because it only works if all properties have the same characteristics. Called the Sales Approach, it requires gathering the sales price of nearby comparable property, then making adjustments for different traits. This leads to inaccuracy, since the unique quality of real estate is that location can contribute greatly to how a property is used which determines what its value might be, and no two properties can occupy the same location. Other characteristics such as floor plan, parking, zoning, ingress and egress can also contribute greatly to value.

Sometimes, owners value real estate based on what they paid for it, or what someone last offered for the property, or the cost to build the property new. In reality, the cost of property has little to do with market value, and an offer made by one buyer does not mean a different buyer would value the property at the same price. The market value is the price a property would bring in an open and competitive market, with a willing buyer and seller knowledgeable about the facts. The cost approach works when you have the time, financing and a reliable contractor to build an alternative structure.

Whether you own stocks or bonds or real estate, the best method of valuing an asset is the present value of all future cash flows. The underlying principal is that a dollar one year from now is worth less than one dollar today, because you could invest that dollar today at some interest rate which will grow in one year to a value of more than one dollar. Here is the math:

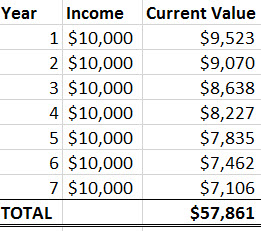

Let’s put this information to work and say a property delivers $10,000 annually in Cash Flow After Taxes. The current value is the sum of future cash flows. You calculate each year’s cash flow, discounted back at an interest rate you could earn on other investments. Let’s assume 7 years at a 5% interest rate and change the n value to match the number of years in the future.

In summary, $57,861 today is the same as $10,000 for 7 years, assuming 5% interest rates. Therefore, if a property had a 7 year lease that produced income of $10,000 annually, the current value of that lease income alone would have a value of $57,861. If an investor required a 10% rate of return, he or she would be willing to pay $578,610 for the property, just to get the lease income.

Not all income is the same however. Let's examine how to determine cash flow income.

With commercial real estate, the best measure of income is called Cash Flow After Tax, and here is how it is derived.

- Vacancy and Credit Losses

- Operating Expenses

- Annual Debt Service

- Tax Liability

= Cash Flow After Taxes

Source: CCIM Financial Analysis, "The Appraisal of Real Estate", 14th edition, Mark Rattermann, MAI, SRA.