At first glance, imposing tariffs or quotas appear to be the perfect solution to get American industries back on track to prosperity, but the reality is that tariffs steal money out of consumers’ pockets by causing prices to increase, stifle creativity, reward inefficiencies and destroy the competitive drive that allows a free market economy to deliver cheaper, smarter and innovative products to you. If you skipped college or avoided a business degree, you missed the basic economics course that explains why tariffs and quotas work in communist countries but never work in a free market economy. This article refreshes you on Econ 101 and explains why tariffs in America cost you over $70 billion every year.

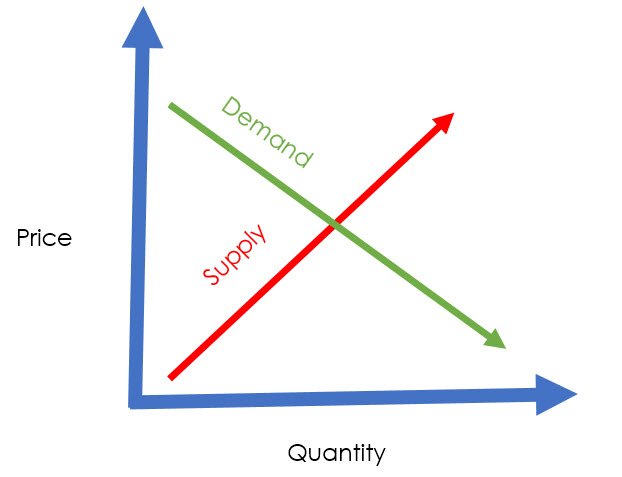

Supply and Demand Curves

The price of a good is the intersection, or equilibrium, of the demand and the supply. The chart illustrates the interaction between increased quantity and increased prices for buyers (demand curve) and suppliers (supply curve). The supply curve always rises since as prices increase, providers of goods want to sell more, and the demand curve always declines, since as prices rise, consumers always want to buy less. The intersection of supply and demand tells us the long term equilibrium of price and quantity.

A tariff is a tax on imports, paid to the government. Domestic producers are exempt from the tariff. A quota is a limit on the quantity allowed to be imported. The result of both is an increase in the price of the good, from the market price to the new tariff price. American manufacturers get to charge the new price, but manufacturers overseas receive the market price but pay the tariff to the US government. The government gains area “D”, the revenue from the tariff; however, American consumers pay the higher price measured by areas A+B+C+D. Even if the government passes along to consumers the revenue from the tariff, the loss to consumers is still area B+D.

Tariffs Cause Consumers To Pay Higher Prices

Tariffs and quotas are not sound public policy. They undermine competitive discipline which forces industries to always reduce cost and increase efficiency, driving creativity and invention. Protectionism has a narcotic effect, allowing sick industries to avoid facing up to their problems.

America has many precedents that teach us tariffs are bad policy, and the most obvious is the one industry promoted that tariffs will help today: steel. Going back 70 years, the steel industry was an oligopoly, with just a few manufacturers and little competition, allowing the industry to raise prices 9% annually in the late 1940’s, twice the rate of wholesale prices. In the early 1950’s, steel prices increased 4.8% annually at a time when the wholesale price index was falling. In the late 1950’s, steel price were increased 7.1% annually, three times wholesale prices. In 1969, quotas were imposed and steel prices increased 14 times greater than they had in the previous 9 years, during a time of recession and 25% of industry capacity in an idle state. The result was a lag in technology. American steel companies failed to introduce the oxygen process and continuous casting which put them at a disadvantage. Their oligopolistic pricing policy kept American companies from competing in the world market and eventually allowed imports to erode their market by producing a better product at a lower price.