It is no surprise that the Chiefs will win the Superbowl by 7 points tomorrow, but the latest data on the New Orleans office market will shock you. We analyzed all the current listed office space for lease in New Orleans, looking for insight to future trends by examining 2,878,471 square feet for lease in 493 listings in 95 different properties. We discovered that only 9% of the listings account for 36% of the square footage for lease. We also examined what type of operating expenses are commonly passed through to tenants, and are able to conclude some surprising trends on the New Orleans office market for lease. Let's get started.

We have been researching and writing about the commercial office market in New Orleans and Louisiana for 10 years now, and there is an interesting history to it. The New Orleans office market is different from the Metairie market and most other large population cities in the South. Most of the downtown office space is located in high rise office towers, with the oldest built during the oil boom of the 1970's by now banker/developer Joe Canizaro, but the last office tower was built in the 1980's.

The office tower movement began as the Canal Street retail sector started a decline and the parallel Poydras Street became the place to be, but no new office towers have been constructed in the last 35 years in New Orleans.

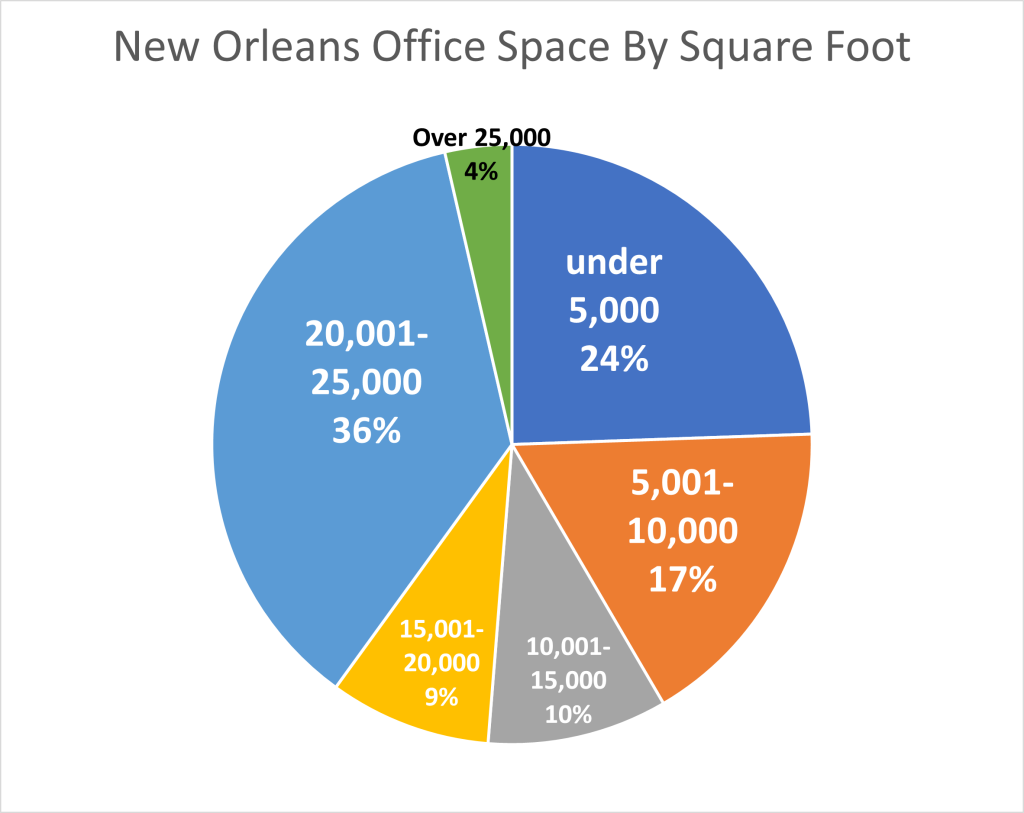

Currently there are 95 office properties with space for lease in New Orleans, with a total of 493 listed individual spaces. Of the 493 spaces for lease, the largest number of square feet for lease is between 20,001 and 25,000 square feet in size, with 36%, or 1,048,003 SF for lease total.

This has major implications, since these are usually full floor spaces that the landlord does not want to subdivide; so for the space to be leased, you would need a large company coming into the area with 50-100 employees, looking for office space, or you would need a law firm, accounting, engineering or architectural firm to relocate out of an existing space. New Orleans has none of those.

The conclusion is that the majority of these large office spaces will never be leased, especially because landlords refuse to reduce the rents to attract tenants, since the value of the building, and thus the loan to a lender, is connected to the current asking rent rate, as well as net operating income. As values fall, lenders will require owners to add funds to maintain equity/loan ratios, causing highly leveraged properties to default.

The good news is that the next highest bracket of listed office space for lease is a size less than 5,000 square feet, which accounts for 24% of the market and 68% of the number of listings. This size office space can attract newer businesses such as start-ups, which we find in New Orleans because people visit, then love the culture, and then decide to stay and open or relocate a business.

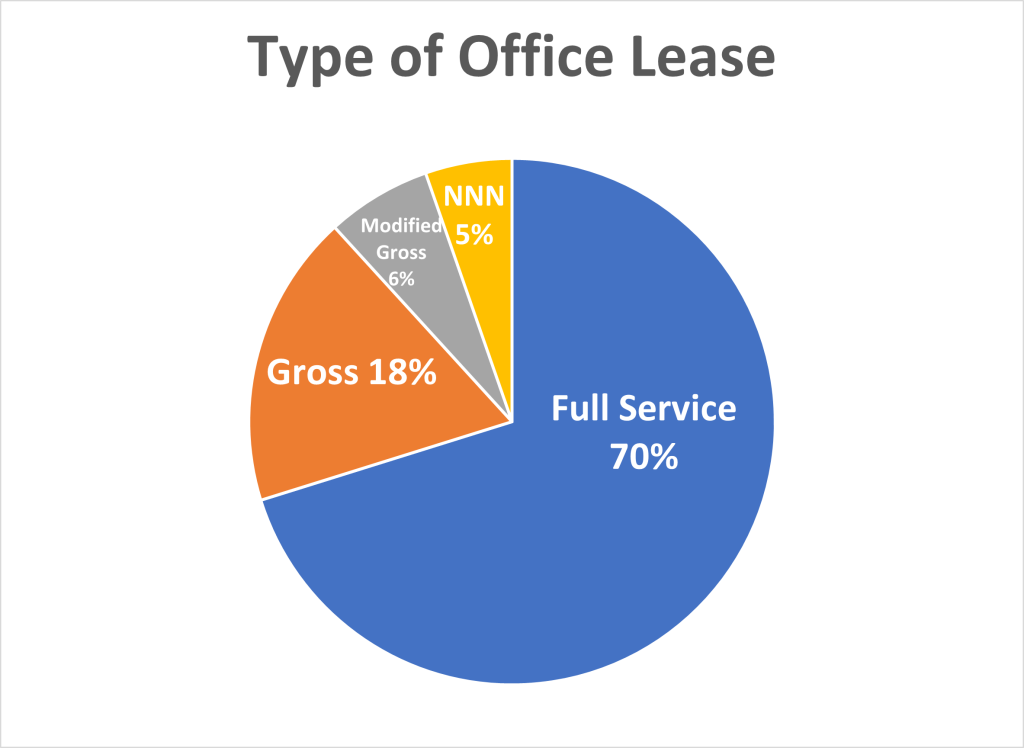

About 70% of the square footage for lease, 1,926,363 SF, is priced as full service, which means all utilities are included in the rent rate. Only 5% were triple net, which means all operating expenses are passed on to the tenants, including, property taxes, fire insurance and unusual but expensive issues like restriping the parking lot. Here are Moody's definitions of the various types of lease pricing:

The New Orleans office market reflects the national trend in declining occupancy, and not necessarily due to Covid. The population in New Orleans has been declining over the last 10 years, and recently was named as the number one city in the nation for population decline rate. The long term office market trend follows population growth, and a movement by employers to force employees back into the office won't fix it.

One solution offered is to convert office towers to needed residential space. We negotiated one of the largest office leases in New Orleans, 75,000 square feet, representing building owner ENI who leased several floors to the adjacent Hyatt Hotel to be used as hotel space, and we concluded that business model will not work for the other office towers in New Orleans, It is just not economically feasible.

Compounding the issue is that office tower owners are unwilling to lower prices to increase demand. The result will be that highly leveraged office towers will fall back into the hands of lenders, continuing the decline in the Class A office market, and decimating the Class B office market who will be forced to lower prices much further.

Stay tuned for our next report on prices of the New Orleans office market and also trends in the Metairie office market. For more information on prices and office space leased, catch our blog: A Drill Down Into 2023 vs. 2024 Office Market