Since the major cities in Louisiana have such different economic drivers, lease prices for the same commercial property type can be as far apart as Scooter Braun and Taylor Swift. This article looks at price trends over the 3 months from May to July 2023 for 11,700 listed lease spaces in each major city for the major property sectors: retail, office, industrial and shopping center. We found some trends that help forecast future prices but also some trends that defied proven economic theory. Let’s get started.

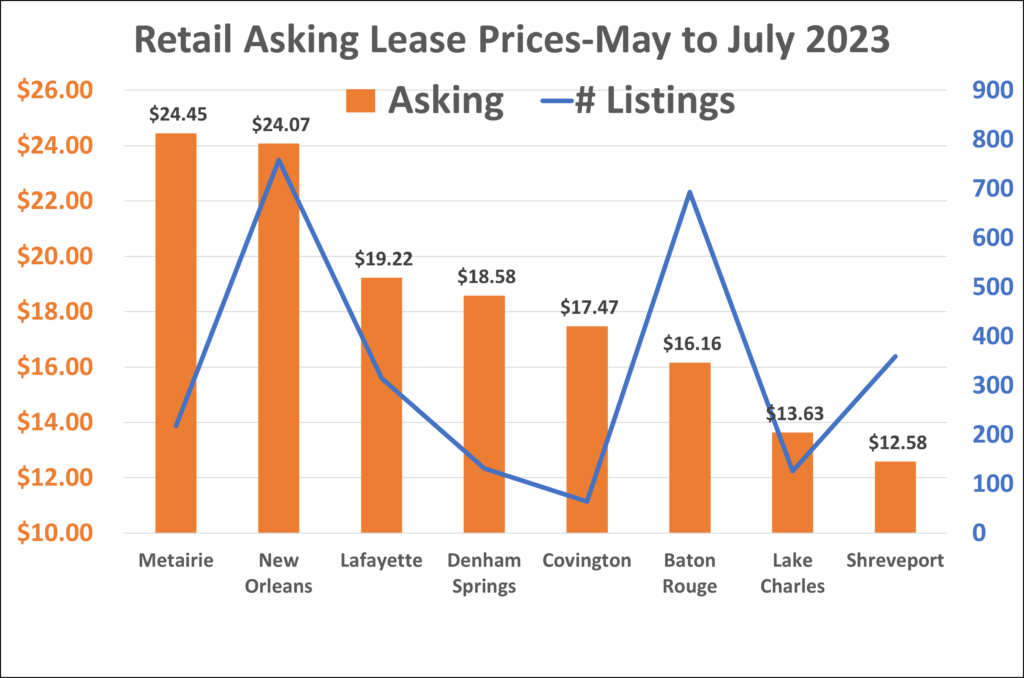

First, let’s look at the retail sector. We examined the asking lease price for 2,800 listings where the average lease price was $17.60 per square foot; however, the actual price leased was $16.40. Asking lease prices ranged from $12.58 to $24.45, with Metairie and New Orleans commanding the highest lease prices and Lake Charles and Shreveport suffering with prices half of those. New Orleans accounted for 30% of all spaces leased and Baton Rouge with 20%, with Metairie, Denham Springs, Covington and Lake Charles only leasing 12 spaces. Total. Over 3 months.

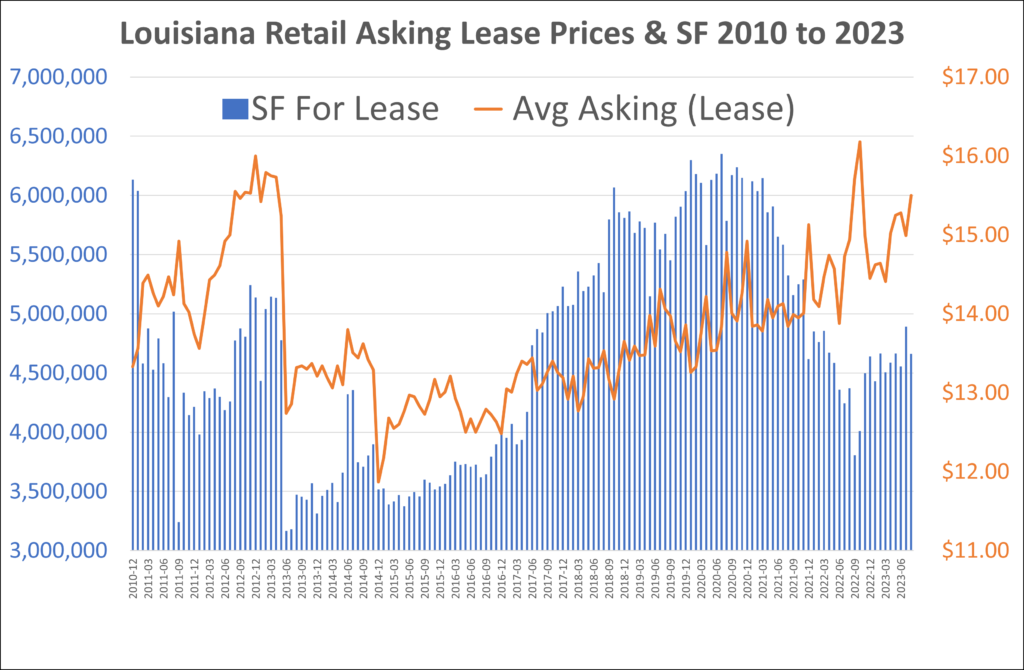

From 2010 until 2017, the supply of space for lease declined from 6,000,000 square feet to 3,000,0000, but the asking prices for retail space also declined, hitting a low of $11.87 per square foot in December 2014. Supply then increased until peaking in 2020 at 6,000,000 square feet, then declined again to the current level of 4,600,000 square feet for lease. This defies economic theory that states increased supply must lead to reduced prices. But that theory has an assumption that demand remains steady. So, the explanation that defies Alfred Marshall’s 1890 law of supply is that demand simply changed. From 2014 to 2020, supply increased 100% but prices increased 24%, so demand for retail space increased dramatically. Then came Covid. Retail space for lease plummeted 36% but prices kept rising from $14 to $15.50 per square foot. The conclusion is that since 2015, the Louisiana retail sector has been very healthy, despite online shopping and Covid, with demand for retail space fueled by a fervent shopping consumer.

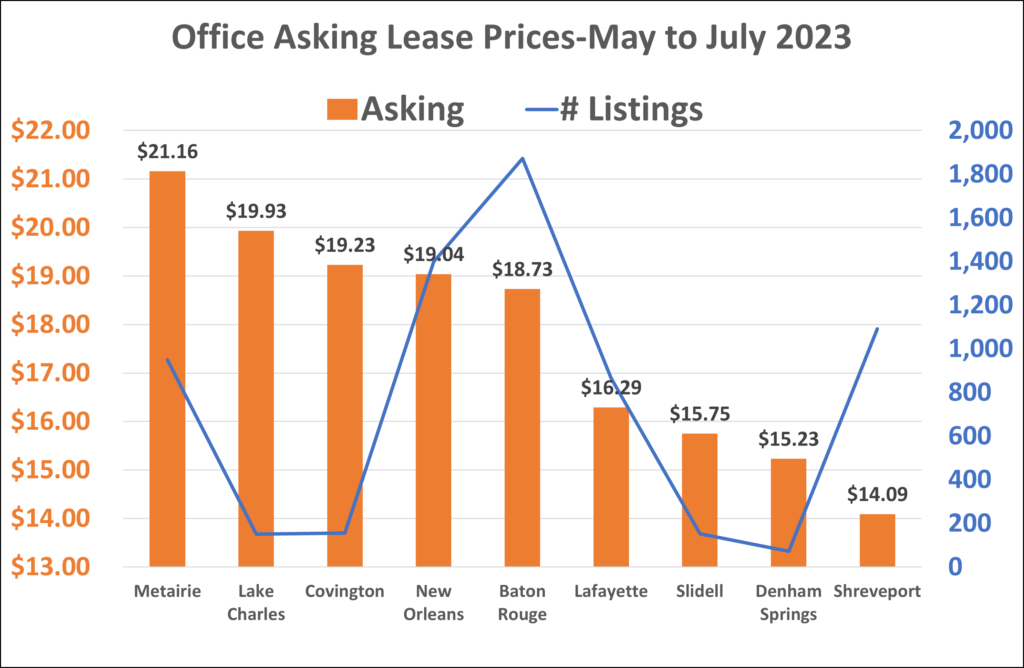

We examined 6,700 office spaces for lease, which comprised 57% of all the sectors. Metairie and Lake Charles commanded the highest office prices and Slidell, Denham Springs and Shreveport were all near the bottom. New Orleans and Baton Rouge have 50% of the market, but the real winner is Lafayette that closed 22% of the office listings in the last 3 months but only has 13% of the listings. Something is going on in Lafayette.

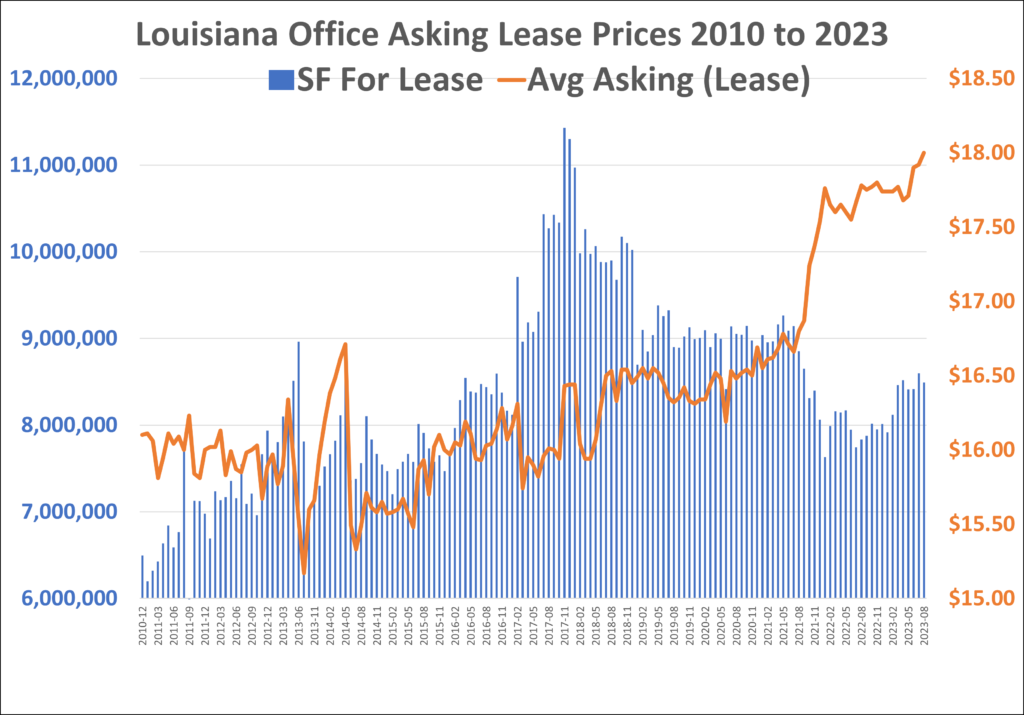

The office market since 2010 tells a different story than the retail market does; instead of a decline, then an increase, then another decline and another increase, the office market increased in supply from 2010 to the peak in 2018 but has declined ever since. That leads to the explanation of why prices have increased from $16 per square foot to $18: because there has been little new construction of office buildings. Why no new construction? There is little demand in office space due to a population decline. Office building demand is based on the number of workers, which is based on the number of people at working age. Louisiana’s population has declined, with the 2021 year witnessing the largest one year population decline since Katrina. The decline in office square feet for lease has resulted in an increase in price from $16 to $18 per square feet, but this trend cannot continue if the population continues to decline causing the need for office space to house a declining work force to decline with it.

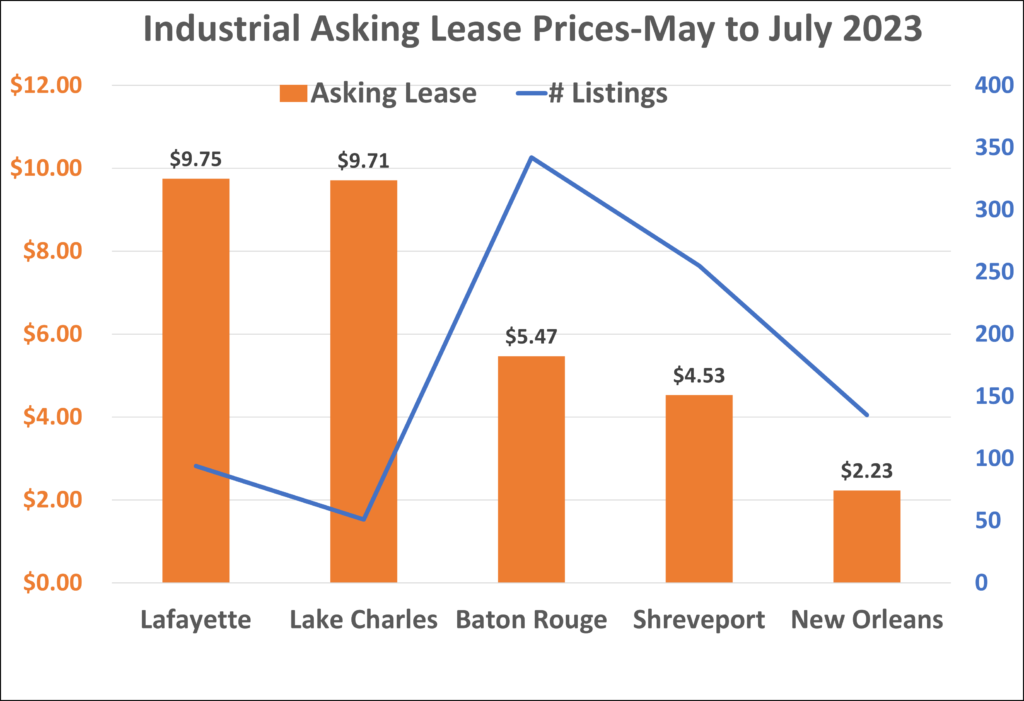

The industrial lease market in Louisiana is small with 875 listings accounting for 7% of the total. The big dogs are Baton Rouge and Shreveport with 82% of the leases closed in the last 3 months and 70% of the listings, but New Orleans was sucking hind teat* and only closed 4 leases of their 135 on the market.

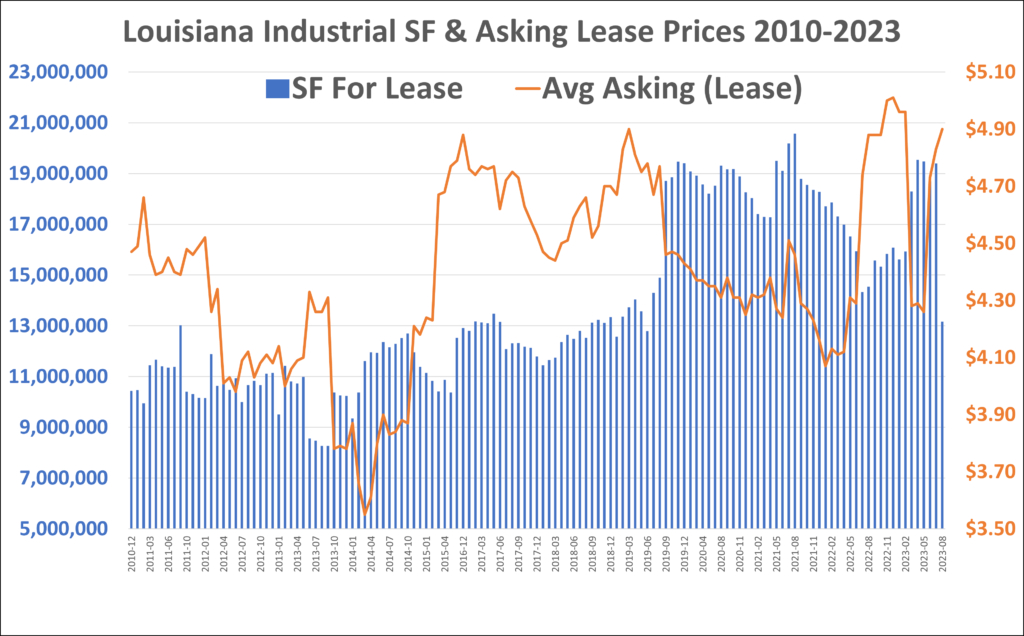

The Louisiana industrial market has the most consistent price, compared to all the other sectors. Over the last 13 years, asking lease prices have been in a narrow range of $3.55 to $5.00 per square foot. Supply has increased from a low of 8,000,000 square feet to 19,000,000 in 2023, with most of the supply coming in 2019 when supply increased from 12 to 19 million square feet.

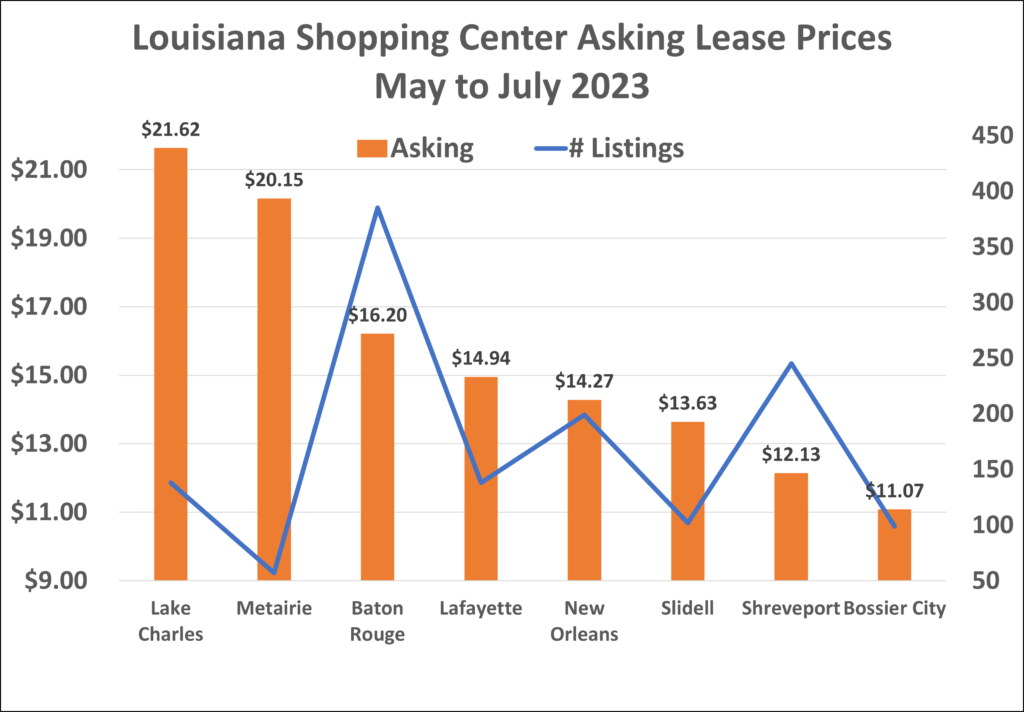

Baton Rouge and Lafayette closed 60% of the shopping center space for lease in the last 3 months, with the other cities only closing 2 leases each. Baton Rouge alone has 30% of the listings. Metairie only has 57 spaces for lease which is 4% of the market, and their average asking price is the 2nd highest. Lake Charles proves to be the strongest market with 138 listings averaging $21.62 per square foot.

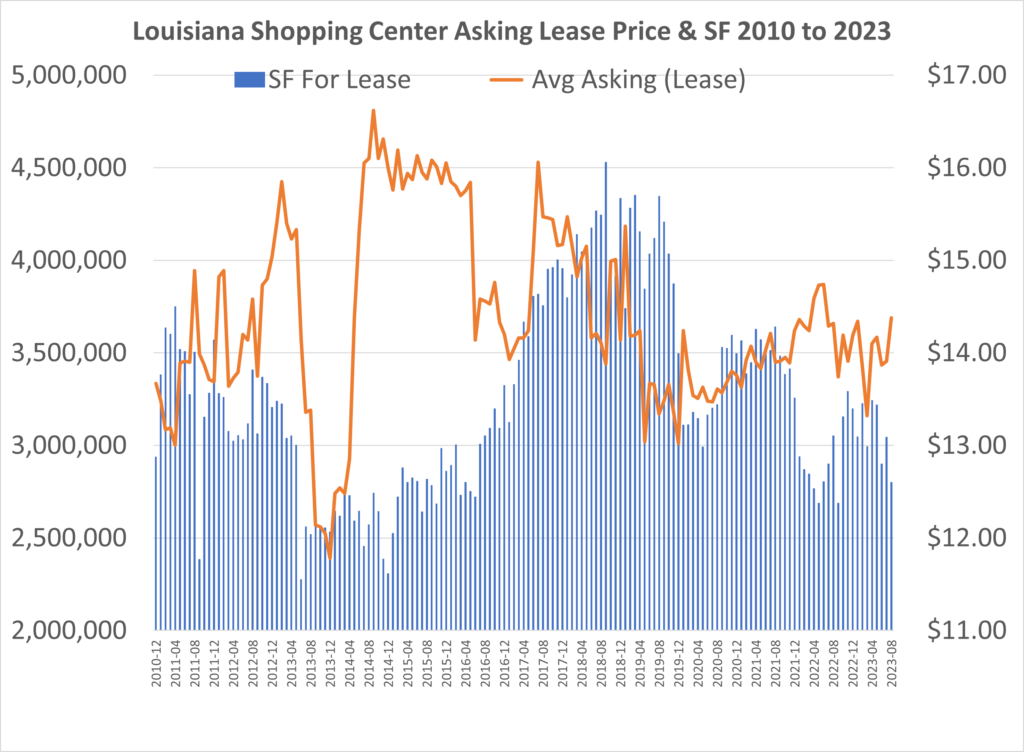

Louisiana shopping center supply bottomed in June 2013 at 2.2 million square feet for lease and peaked September 2019 with 4.5 million square feet. While supply has declined 1.7 million square feet over the last 4 years, lease prices are about the same. In fact, prices are only 5% more now than they were in 2010, over 13 years ago. Owning a shopping center in Louisiana is a tough way to make a living.

Retail: Metairie and New Orleans command the highest lease prices, but Baton Rouge closed 20% of the deals these last 3 months with prices 10% below average.

Office: Lafayette closed 22% of all deals with only 13% of the number of listings. New Orleans and Baton Rouge have 50% of the market, but Baton Rouge closed 58 deals or 30% of the listings in the last 3 months. Metairie has the highest prices but only closed 9% of the listings.

Industrial: Lake Charles and Lafayette have the highest prices, almost double the other major cities but Baton Rouge and Shreveport closed 82% of the leases. New Orleans closed 4. Total.

Shopping Center: Prices are highest in Lake Charles and Metairie, but they only closed 3 leases in the last 3 months. Asking lease prices overall are only 5% higher than in 2010.

For more information on prices, catch our blog New Orleans Office Tenants Leave CBD in Doves.

Copyright 2023. Reprinted with permission.

*This is a farming phrase and nothing derogatory.

Hard data from LACDB, CREXI & Loopnet/CoStar.