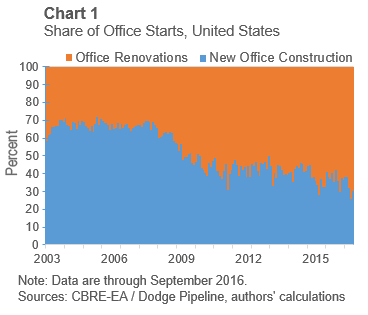

Researching construction activity across 382 metropolitan markets in the United States, data show new office-construction projects were double office renovations from 2003 to 2008, but then everything changed when financing dried up for new construction projects due to the mortgage industry meltdown and collapse of financial institutions. The surprise is that this 2008 trend still affects the office market today.

Chart 1 shows the composition of office starts, comparing new office construction starts to office renovation starts. Office renovation starts include additions, alterations and conversions from one property type to another. Nationwide statistics come from Dodge Data & Analytics, formerly known as McGraw Hill Construction, which collects project-level data and identifies the type of construction including new construction, addition, alteration, and conversion. Results show that new construction has dropped from 65% to 30% of total construction and office renovation is now around 70% of all office construction.

In chart 2, the blue line represents the number of new office construction starts, and the orange line represents the number of office renovation starts. New office construction starts increased sharply from 2003 until 2005, when the number of projects leveled off. Office renovation starts increased during the same period, though at a much more modest pace, then also leveled off in 2005. New office construction starts began to drop in the first few months of the recession and fell sharply until the middle of 2010, while office renovation starts appeared to continue at a steady pace until halfway through the recession before softening a bit. Both new office construction and office renovation starts flattened out and continued at an unchanged pace throughout the early years of the recovery. New office construction starts experienced very little in the way of an uptick until 2016. Office renovation starts, on the other hand, began to rise at a fairly quick pace starting in 2015.

Office demand nationwide has been steady and is somewhat correlated to GDP but can vary widely by market. In major cities, Class A office space is in high demand, but in smaller markets, office rates are often offset by substantial free rent and tenant improvement allowances. Until financing for new construction becomes more available, new office construction will continue to decline. Eventually this will lead to higher lease rates, which will, in turn, lead to new construction. The free market system will always drive toward equilibrium, so keep on eye on lease rates which will trigger the trend change.

For more information on the office market, read our articles: