With 30 year Treasury Bonds yielding 3.79 percent, many investors as well as institutions are considering investing in commercial real estate. How do you know whether the market is right to invest or not? This article presents a strategy for analyzing whether or not it is feasible to develop commercial office property.

With 30 year Treasury Bonds yielding 3.79 percent, many investors as well as institutions are considering investing in commercial real estate. How do you know whether the market is right to invest or not? This article presents a strategy for analyzing whether or not it is feasible to develop commercial office property.

The first question you'll need to answer is whether rents are high enough to justify new construction. This concept helps the analyst determine timing, as well as the difference between required rent and market rent based on known costs and expected returns to the investor. The capitalized difference between feasibility rent and market rent represents total depreciation if market rent is less than feasibility rent.

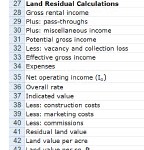

Given the information below, is this project currently feasible?

The quick answer is that the project is feasible. Here is how we get to the answer:

The conclusion is that as long as market rents are above $13.38/square foot, that the project is feasible.