This newsletter looks at price trends as of September 2023 for 9,018 listed properties for lease and for sale in the entire state of Louisiana, plus we drill down for major city trends as well as compare asking prices to actual transacted prices. We found some trends that help forecast future prices but also some trends that are harder to figure out than Taylor Swift and Travis Kelce. Let’s get started.

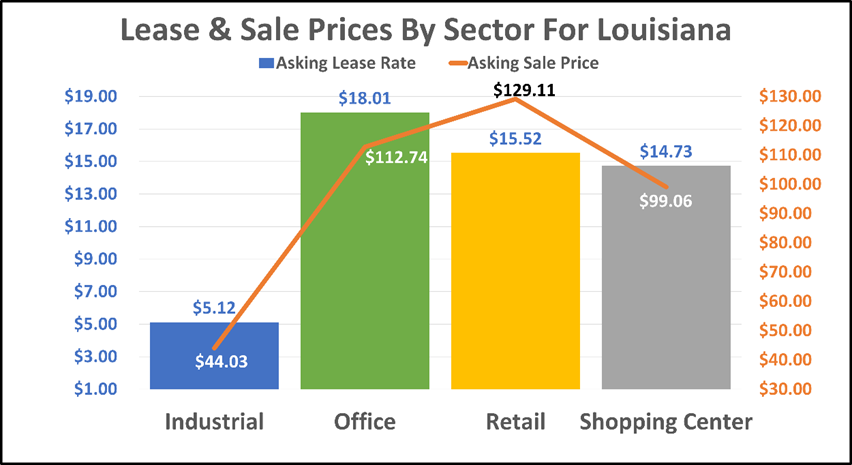

First, let’s look at average sale and lease prices for the major sectors in the entire state of Louisiana. We examined 9,018 listings with 26 million square feet for sale and 30 million square feet for lease.

We examined 6,967 office listings for lease over the past 3 months which had 194 actually leased. Of the 194 leases closed, Metairie had 21 leases and commanded the highest asking price of $21.27 per square foot and actual transacted lease prices were only discounted 3%, averaging $20.57 per square foot. Lake Charles, Slidell, Denham Springs and Bossier City only averaged 1 lease transacted per month each which explains the anomaly of actual lease prices higher than asking. Baton Rouge closed the highest number of leases at 66, averaging a 17% discount, but Lafayette is again the big winner closing 36 leases at a 3% premium.

Of the 3,048 retail lease listings, only 3% or 95 were closed in the last 3 months. Metairie lists 232 spaces and only closed 6 but commands the highest asking lease price at $24.78 with actual price averaging $23.29. Baton Rouge has the most listings at 715 and closed 22 but New Orleans closed the most at 31 which is a large enough sample so is not an outlier but still unusual, averaging $25.83 per square foot which is a 7% premium to the asking price.

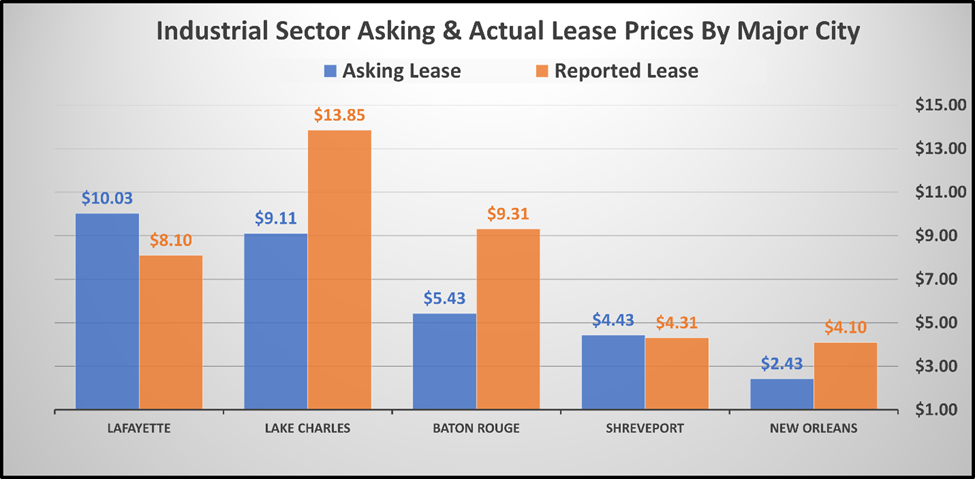

Lafayette commands the highest asking lease prices in the industrial sector at $10.03 per square foot but actual lease prices averaged a 20% discount at $8.10, on the 7 leases closed of the 101 listed. Among the major cities, there are 899 industrial lease listings and 42 spaces were leased, with Baton Rouge the most active with 18 leased followed by Shreveport with 13 leases closed. New Orleans and Lake Charles only closed 2 leases, so their actual lease prices at a large premium to asking prices were outliers, proving that in slow markets, only the prettiest warehouses get the attention.

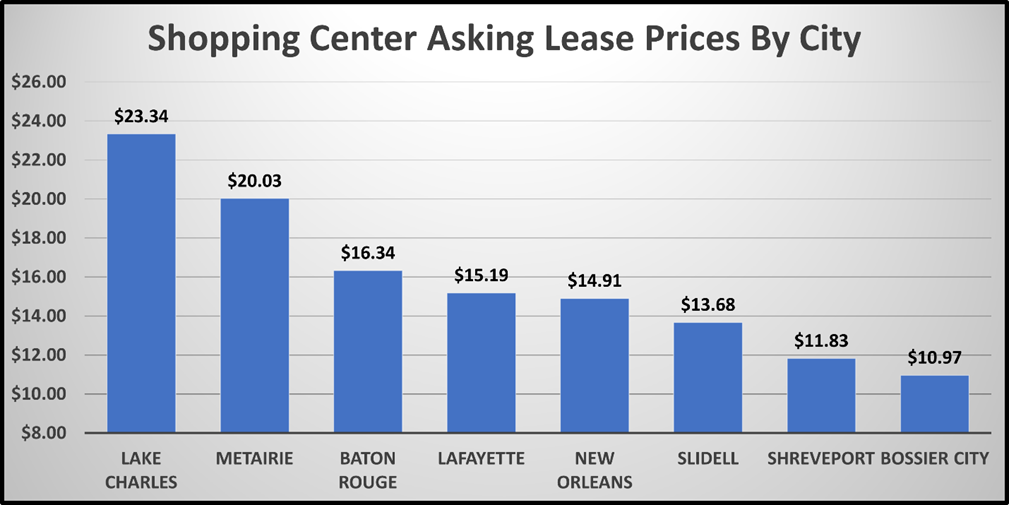

The shopping center market is slow. The chart shows only the asking lease prices of 1,364 lease listings. Since only 19 leases were transacted, comparing reported prices is as crazy as a Sam Bankman-Fried interview. Baton Rouge had the highest number of transactions at 7, averaging $15.56 per square foot on actual lease transactions or a 5% discount to the $16.34 asking price.

Three revelations arise when you look at all the data.

For more information on prices, catch our blog Which Commercial Property Databases Are Best In 2023?

Footnotes: The Hospitality and Multifamily sectors did not have enough sales in this time period for the data to be reliable, but we will cover those sectors later.

Sources: Crexi, LoopNet, LACDB, MSCREX.