This blog reviews the sale trends the last 3 years in the 4 major sectors of New Orleans commercial real estate, with an explanation of why some sector prices have remained flat while other sectors have seen price increases.

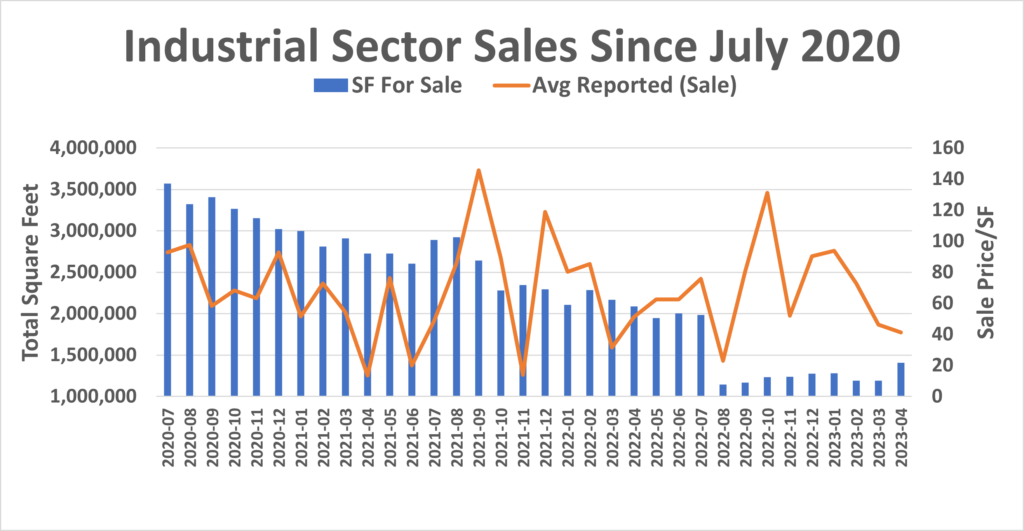

The number of industrial listings for sale has declined the last 3 years from 106 totaling 3.5 million square feet to 54 totaling 1.4 million square feet. There has been an average of 3 sales per month at $70/SF on the market for 316 days and 30,000 SF in size. Prices defied the law of economics since supply declined 50% but average sale prices have not increased. The reason is that while square footage declined, so did demand which went to areas outside New Orleans, missing out on the nationwide explosion in warehouse space driven by Amazon and the ecommerce industry.

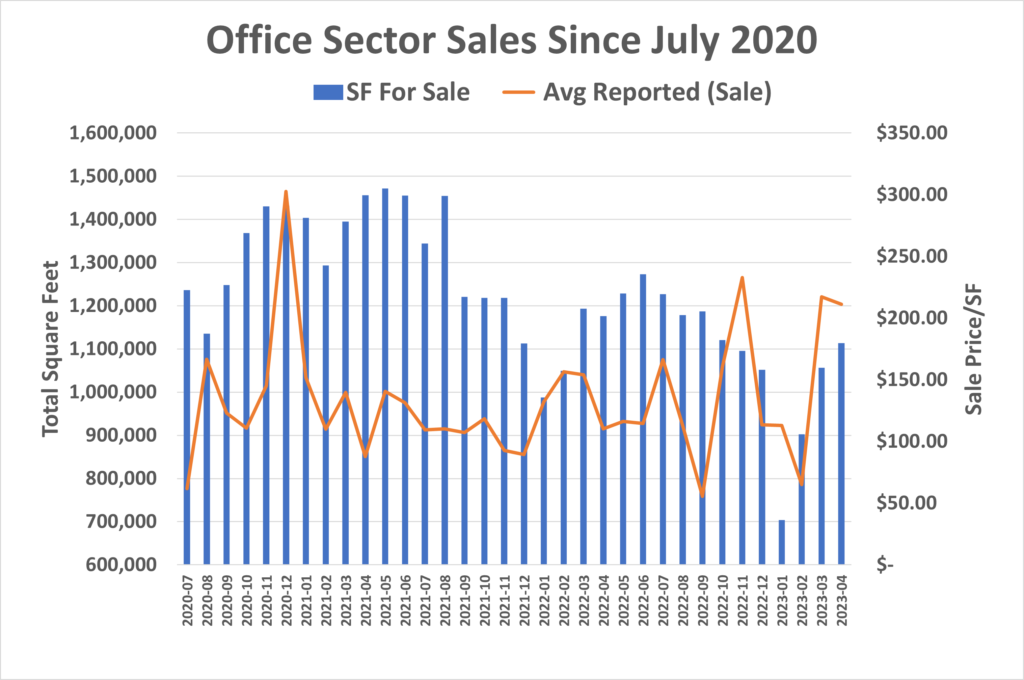

The number of office listings for sale has declined the last 3 years from 135 totaling 1.2 million square feet for sale to 103 totaling 1.1 million square feet, but ranging as low as 700,000 square feet to a high of 1.47 million square feet. There have been an average of 7 sales per month at $133/SF and on the market for 282 days. The average sale size was 10,600 square feet.

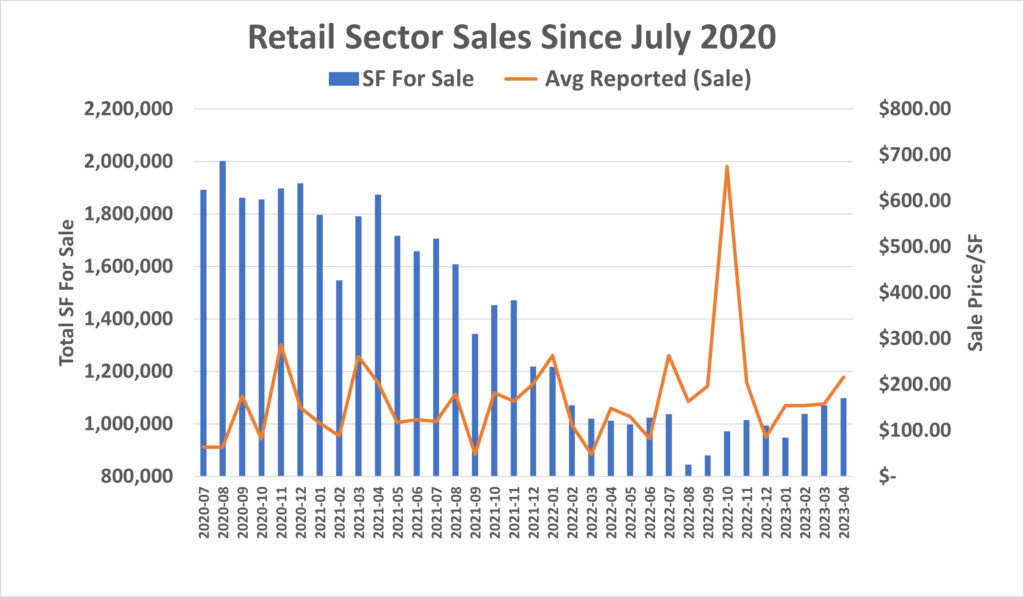

Retail sale listings declined from 174 totaling 1.9 million square feet to 134 listings totaling 1.1 million square feet. The average size was 10,000 SF, on the market 286 days and sold only 6% below the list price. There have been an average of 7 sale transactions per month at $167/SF, but prices have ranged from $47/SF to $200/SF, with an October 2022 outlier peaking with 7 transactions averaging $674/SF.

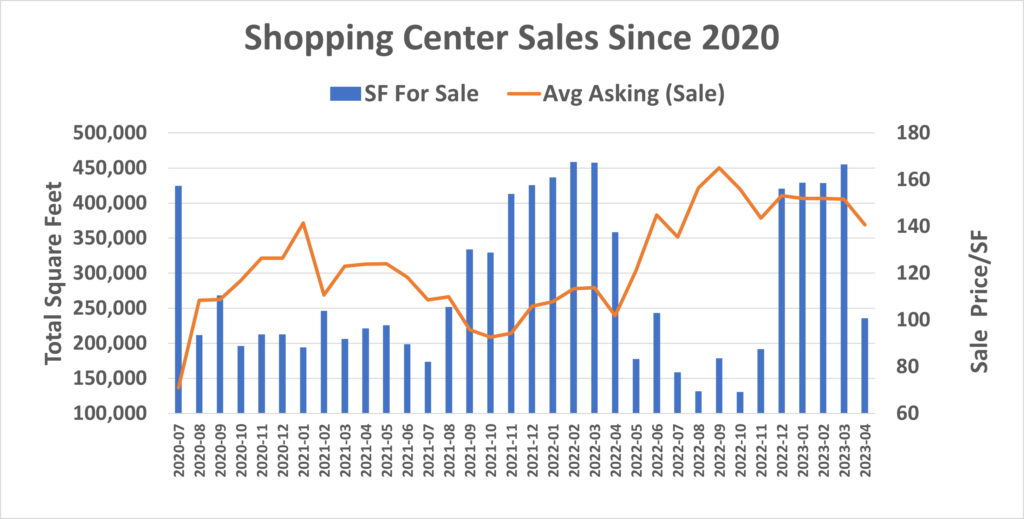

Only 25% of shopping center sale prices are reported, so substituting the list price, the average price was $123/SF for the 17 shopping centers total sold the last 3 years. Listings are scarce, with a monthly high of 15 on the market to a low count of 7 listings available monthly during the summer of 2022. Total square footage averaged 280,000 with the average size shopping center at 26,000 square feet and taking an average of 449 days to sell.