Whether you rent office space in a Class A office tower, warehouse space to store inventory or retail space for your coffee shop, your lease probably includes terms that are not good for you but that you agreed to anyway. This article exposes common lease mistakes and explains that unless your lease language is clear on every detail, even small mistakes can be very costly.

Here is an example of the lease language used by $2.6 billion market cap Regus PLC in 3,000 locations:

If this agreement is for a term of more than 12 months, the Provider will increase the monthly office fee on each anniversary of the start date. This increase will be by the local Consumer Price Index or such other broadly equivalent index where a consumer price index is not available locally.

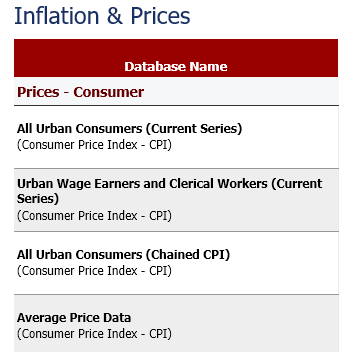

This Regus lease language leaves lots of room for dispute because the consumer price index has several ways of being calculated. The CPI index is produced by the Bureau of Labor Statistics, under the United States Department of Labor and the four types of consumer price indices are:

All Urban Consumers (Current)-Consists of all urban households in Metropolitan Statistical Areas (MSAs) and in urban places of 2,500 inhabitants or more. Nonfarm consumers living in rural areas within MSAs are included, but the index excludes rural nonmetropolitan consumers and the military and the institutional population.

Urban Wage Earners and Clerical Workers (Current)-Consists of clerical workers, sales workers, protective and other service workers, laborers, or construction workers. More than one-half of the consumer income has to be earned from these occupations, and at least one of the members must be employed for 37 weeks or more in an eligible occupation.

All Urban Consumers (Chained)-The urban consumer population is deemed by many as a better measure of the general public because 90% of the country’s population lives in urban areas. Using chained CPI means the rate at which Social Security benefits tick up would be slower, because it reflects substitutions consumers would make in response to rising prices of certain items. It utilizes a basket of goods and services that are measured changes from month to month; much like a daisy chain. If the cost of a certain form of transportation goes up, people might switch to another kind and this kind of “substitution” is part of what is factored into chained CPI.

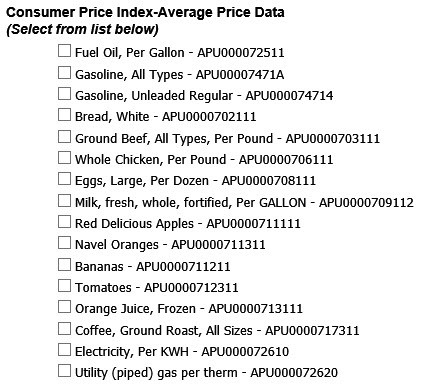

Average Price Data– Calculated for specific items such as, household fuel, motor fuel, and food items. Average prices are best used to measure the price level in a particular month, not to measure price change over time.

The most common CPI Index is the All Urban Consumers Index, but it has two methods used to calculate the numbers: one uses a base period 1982-1984 as 100, and the other method uses a base period of 1967 as 100. Most leases make the mistake of not being clear about which index is used. In addition, the data can be seasonally adjusted or not seasonally adjusted (which is released faster).

Here is another example; this language for a medical property that makes the CPI data source very clear:

Consumer Price Index: It is further understood and agreed by and between Lessor and Lessee that, commencing with the first day of the second year of lease, the monthly rental as set forth above will be adjusted upwards at the beginning of the second lease year, and every year thereafter until expiration or termination of the lease using the all urban consumers (CPl-U) United States City Average, All Items, (1967=100) published by the Bureau of Labor Statistics, United States Department of Labor (referred to as "Consumer Price Index").

| Year | CPI | Rent Annually |

| 0 | 3.00% | $100,000 |

| 1 | 3.00% | $103,000 |

| 2 | 3.00% | $106,090 |

| 3 | 3.00% | $109,273 |

| 4 | 3.00% | $112,551 |

| 5 | 3.00% | $115,927 |

Always compound if you are the landlord and never compound if you are the tenant. When adjusting for the CPI, it makes a difference if you add the inflation rate for each year rather than multiply the rate by the previous year. Assume a 5 year lease renewal where the CPI was 3% each year for the previous 5 years. Some landlords multiply 5 years times 3% to get 15% for the increase. For a large property with rent income of $100,000 annually, the adjusted rent would be $115,000; however, if the lease is written so the CPI is compounded, meaning each new year is applied toward the previous year’s CPI, the result is rent of $115,927 in year 5. Your lease renewal should spell out how the CPI is calculated.

Our economy today is driven by a different wage/price spiral, due to Covid shortages because almost all of our goods are made in China so when they stopped manufacturing, the shortage caused inflation. Inflation hurts landlords and savers. Most leases build in a fixed rate adjustment in addition to a CPI adjustment because the challenge for landlords is that the CPI since 2000 has averaged 2.5% and 2.4% since 2010. Even 3.6% CPI increase the last 5 years doesn’t keep up with skyrocketing medical care increases.

One strategy that benefits landlords is to include lease language stating the rent adjusts based on the CPI or a fixed rate, whichever is higher. The 30 year table shows how a 4 percent increase versus a 3 percent increase in net rents annually can increase the value of property by 10 times the initial year lease income. Your lease should include language with adjustments based on the CPI but also compared to a fixed rate, whichever is higher. This example in the table shows, assuming current rent income of $100,000, if the higher CPI or a fixed rate difference was just 1 percent, that at an 8% cap rate adds $1,020,168 more market value to the property over a 30 year lifetime.

In conclusion, make sure your lease language details how your rent is adjusted. You can design your table data at the Bureau of Labor website and, if you need help, their phone number is shown on the data release. If you call the number on the press release, the analyst who produced the CPI report will answer any questions. If your property is in outlier data cities such as Detroit, Houston or New Orleans, you can even produce a local Consumer Price Index. Remember to make sure your lease is clear about what CPI is used, how it is calculated and whether you compound your rate, which is why many tenants and landlords hire an expert to advise them. Remember, lease mistakes can be costly.

Read our nationally published articles:

Using Technology To Make Better Real Estate Decisions