Date: 6/12/2024

Got commercial property to sell? It will not only take much longer than you think but will bring you insurmountable obstacles along the way. Here is how we get it done.

Louisiana’s economy is not booming like Texas or Florida. Even Alabama is thriving. Louisiana is a great place to live with a fascinating culture but a difficult environment to get business done. That means selling commercial property in Louisiana takes longer than most owners can imagine and will involve overcoming lots of obstacles. The average time to lease or sell commercial property anywhere is the state is 212 days. That is why when selling commercial property, you have to be careful with whom you do business. This article explains how commercial property gets sold and what to look out for.

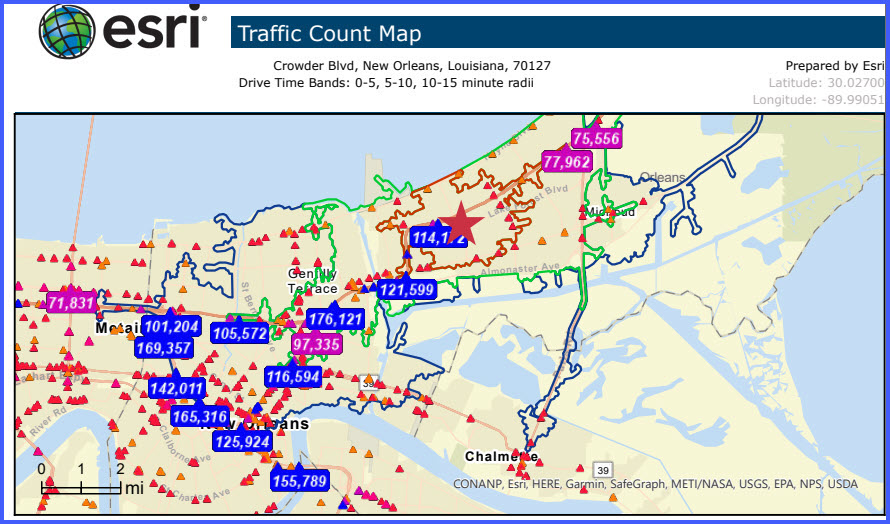

The story that encompasses all the aspects of selling commercial property is 5495 Crowder Boulevard in New Orleans East. I listed the property in 2016 for $1,150,000. It is a 9,000 square foot beauty supply store that brings in $7,000 monthly rent, surrounded by 15,000 square feet of vacant shell high eave retail and warehouse space, on 2.8 acres of paved parking. The property is near the I-10 exit which has 100,000 cars per day pass by.

After heavily advertising the property in LACDB, LoopNet, Crexi and Google Ads, we received 4 offers, ranging from $550,000 to $1,050,000. The highest offer was financed by First NBC Bank in New Orleans. The buyer had an offer from FNBC to finance 100% of the loan, but during the inspection period, the bank was declared insolvent and was the largest U.S. bank failure of the decade. The deal was off.

The property received lots of interest, despite the New Orleans East location stigma, and the next year, the property received an offer of $700,000 from a nearby church, which the seller declined. The property also received a hearing notice from New Orleans Code Enforcement which stated violations regarding signage and a visible dumpster. I attended the hearing with the seller, since he did not speak fluent English.

The hearing was led by two code enforcement officers in a small room. The officers refused to let me answer questions for the seller even though English was not his primary language. We asked for an explanation of what areas of the property were violating the code but the officer replied, “just give the list to your contractor-he will know”. They were rude and abusive to the property owner. Still not allowing me to talk, they replied, “If you sell your property within the next 30 days, you won’t have these problems”. They then cut the meeting short and explained that they have other cases. Later, we talked with Chad Dyer, the Code Enforcement Director, who explained that all they wanted was for the owner to build an enclosure around the dumpster and remove signs from the windows.

Two years after that, in 2019, the property received an offer of $1,000,000 from a developer to build a trampoline/entertainment facility. The pro forma showed the project would generate $200,000 net cash flow within 12 months. This was a brilliant idea from a bold developer and would bring a much needed service to the nearby residents. During the inspection period the seller changed his mind after discussing with his wife and they decided not to sell. They wanted to keep the $7,000 monthly income from the tenant and live off that in their retirement. Then in August 2021, category 4 Hurricane Ida hit the property, causing damage requiring one section of roof to be replaced. The owner lived out of state and realized it is stressful managing commercial property when you live elsewhere.

In 2024, a developer from Georgia, looking to buy property for a truck stop, offered $795,000, but now the tenant no longer wanted to move. Since 2016 the 9,000 square foot beauty supply tenant told the landlord that he wanted to retire because business was not profitable. Upon receiving the only offer in years, the owner stated the tenant now wanted to stay because business was good and seller felt the tenant was “like a son to him”. Normally, no developer would purchase a property with the disadvantage of having the build around an existing tenant, but we negotiated with tenant, seller and buyer, and were able to reach an agreement, drafting a lease between buyer and tenant that would be effective upon sale.

After successfully negotiating an agreement between both buyer and seller with a 45 day inspection period, we introduced the seller to two local bankers who processed the loan applications. After the inspection period passed, the seller disclosed he was unable to obtain financing from either bank. We then negotiated owner financing for 5 years at a 7% rate with 40% down, and proceeded to a successful closing.

In summary, finding a buyer for commercial property in Louisiana takes several months of tactful negotiations. This is why having an expert handle the transaction is vital. Personalities can get in the way, causing transactions that could be successful to fall apart at the drop of a hat. Experienced real estate agents can often find solutions to fragile situations and bring about a successful outcome where all parties are happy.

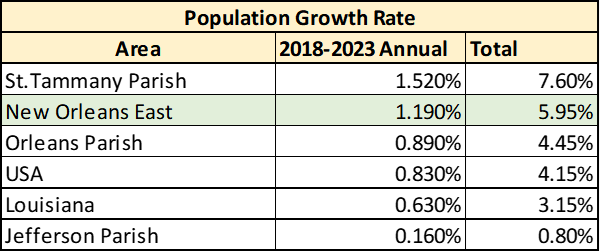

In researching what businesses would do well in the location, we compiled all our information into a publication, “Feasibility of Developments In New Orleans East” which we presented to city council and hosted a television panel at WWL. Our research will surprise you. New Orleans East, despite the stigma, has areas that are thriving. It is the largest area in New Orleans, with 70,000 residents. About half own their own home, and the last 5 years, the population grew faster than Orleans and Jefferson Parishes.

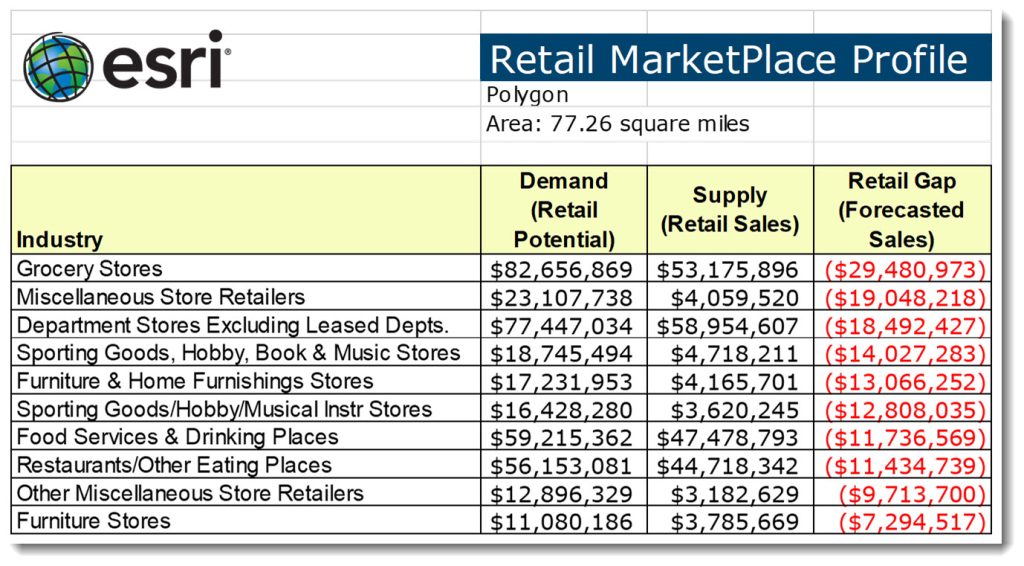

Despite the stigma New Orleans East suffers from the closing of Lake Forest Shopping Center, New Orleans East residents have money to spend. Our research helps businesses determine the perfect location, based on how nearby residents spend their money. The Retail Marketplace Profile shows demand and supply by industry, with the difference resulting in a gap which is the unmet revenues from businesses not in the area. The report shows the number of businesses providing that product in the area, and the Retail Gap is the size of the unmet market demand.

The table shows the top 10 businesses needed in the area, culled from the previous leakage table. The Retail Gap is the forecasted sales. For example, there is a Retail Gap of $29,480,973 in the grocery store industry. Currently there is $82,656,869 spent in grocery stores, but only $53,175,896 in sales in grocery stores within the area. That means the difference, $29,480,973, is spent outside the area. Therefore, the forecast in revenues for a grocery store opening up within the area would be $29,480,973.

Recently, Wal Mart has come into the area, Lowes has closed but the property was purchased by Goodwill who will convert the building into a warehouse/retail facility. LCMC opened the area’s major hospital, with 120 physicians on staff. If you are looking to grow your retail business, contact us for a free Retail Marketplace Report.

For more information on commercial real estate, catch our articles: