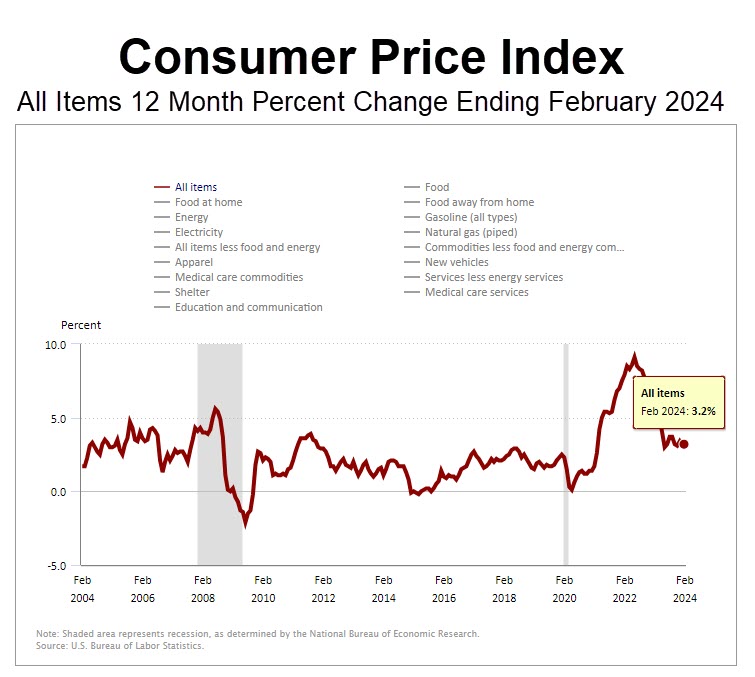

The news just out on inflation is that the Consumer Price Index rose 3.2% for the last 12 months ending February, but what you hear in the news about inflation is that it is only one number which implies that it reflects everything we buy. Not true. This article examines how prices change in various industries and discloses what to look at in order to predict inflation.

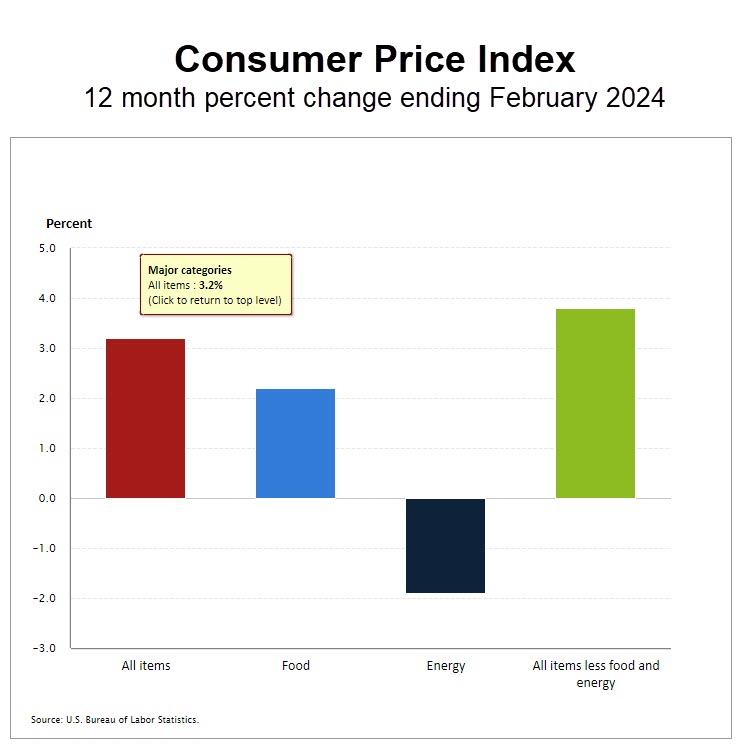

What you hear about most often is called the Consumer Price Index, which is collected from 75 urban areas throughout the country including 23,000 retail and service establishments. Data on rents are collected from about 50,000 landlords or tenants. Inflation is measured by the Bureau of Labor Statistics and includes over 8,000 items, but not all items change prices to the same degree. For example, food prices increased 2% but energy prices dropped 2% over the last 12 months.

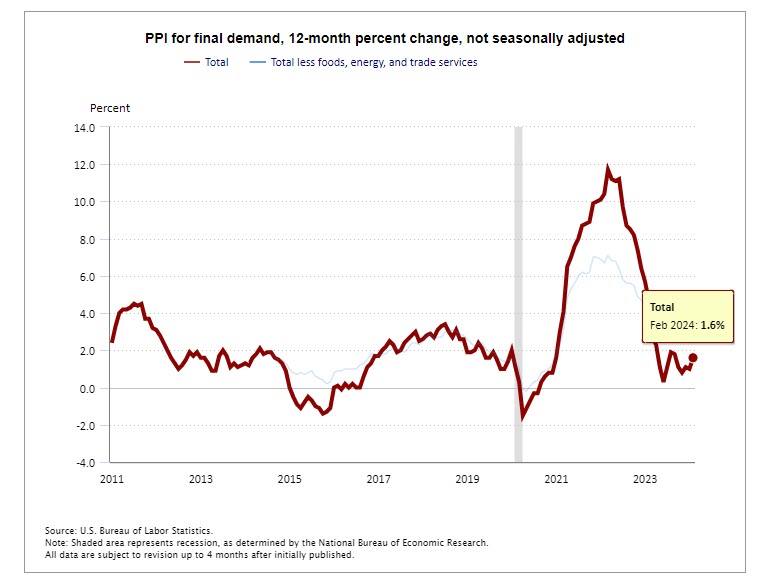

However, if you really want to know where inflation is headed, look at the Producer Price Index, which measures the prices that domestic producers are charging and includes the very first transaction for many goods and services. As products flow through the supply chain, the Producer Price Index measures the first increase in prices from the producer’s perspective which eventually reach the consumer. This is different from the Consumer Price Index (CPI), that measures price change from the purchaser's perspective.

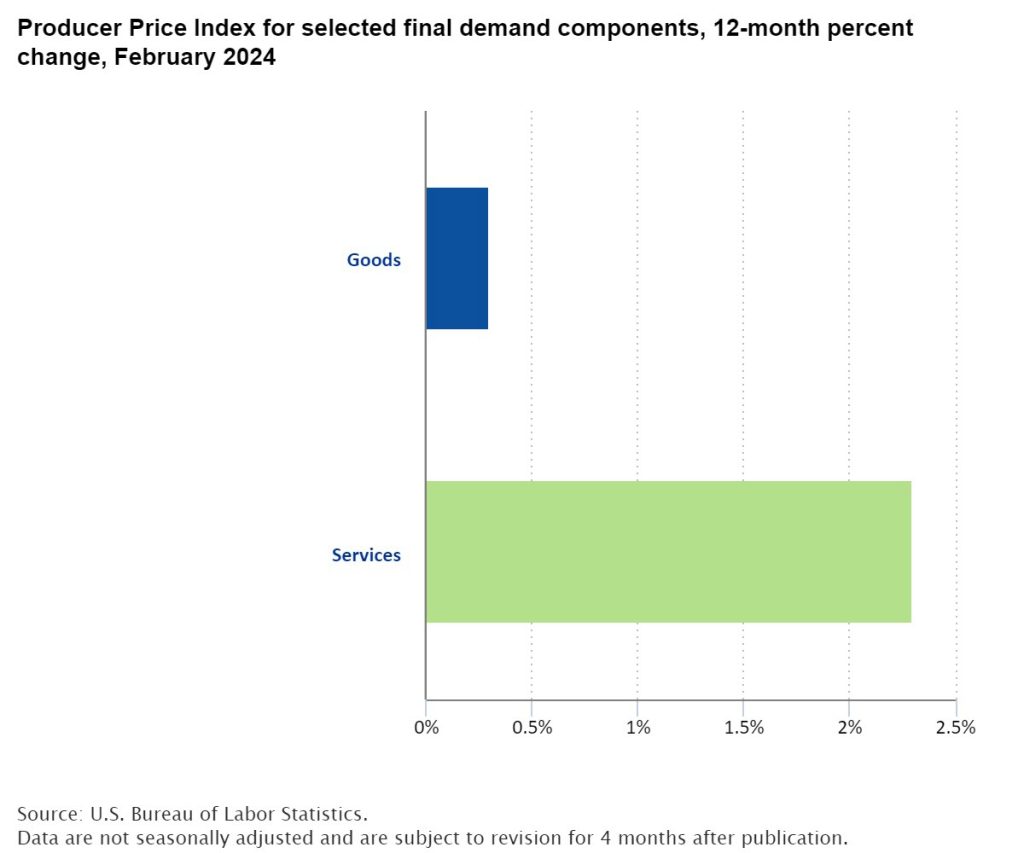

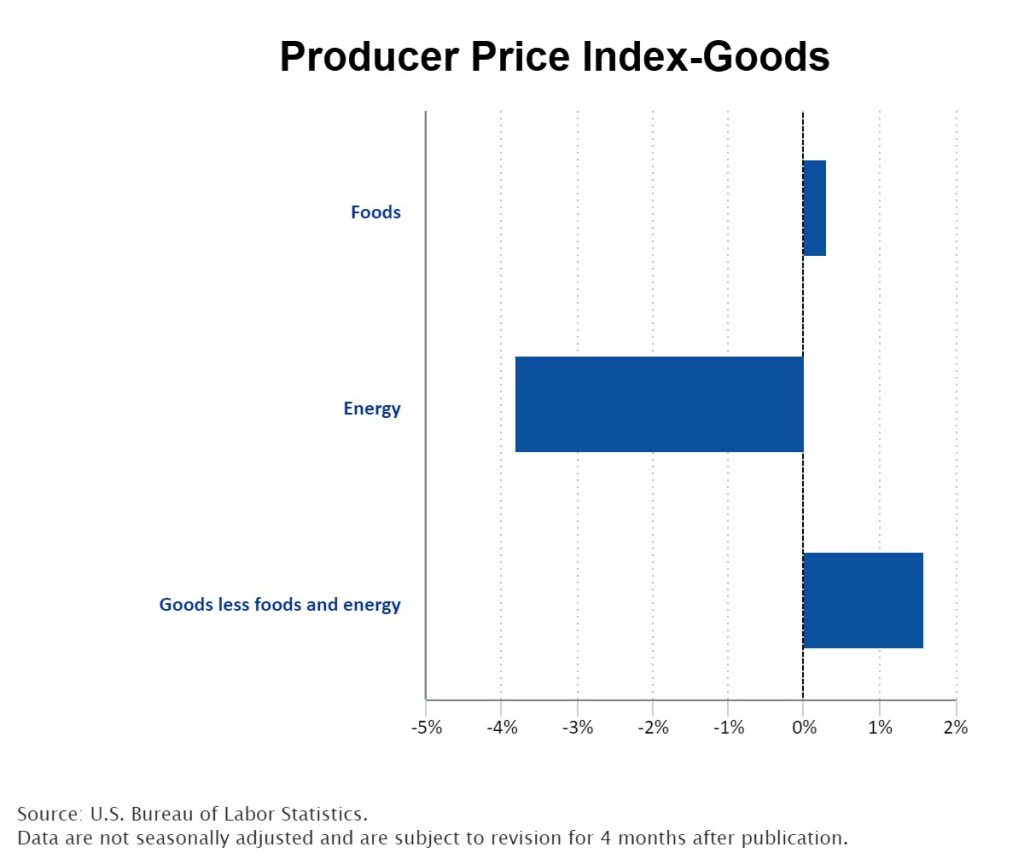

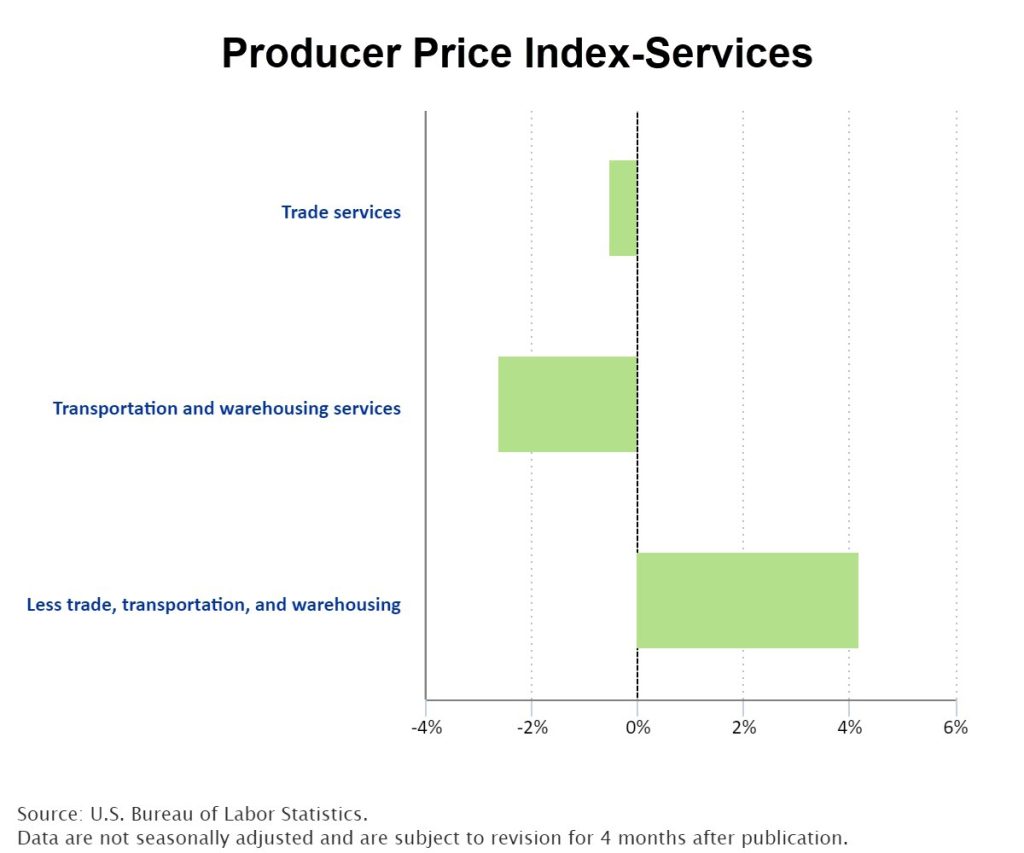

The Producer Price Index covers goods and services. The Producer Price Index increased 1.6% from February 2023 to February 2024. Prices for goods rose 0.3% over the year, while prices for services rose 2.3%.

The PPI service sector includes 69% of service output including wholesale and retail trade, transportation and warehousing, information, finance and insurance, real estate brokering, rental, and leasing, professional, scientific, and technical services, administrative, support, and waste management services, health care and social assistance and accommodation.

The past 13 years the Consumer Price Index has averaged 2.6%, with a low of -0.1% in 2015 and a high of 8% in 2022. During the same period, the Producer Price Index averaged 2.6% with a 2015 low of -0.9% and a 2022 high of 9.5%. The PPI peaked in July 2022 and appears to have established a bottom in December 2023, having a series of higher lows with an overall increase since then.

The big trend is still down and will not go back to the supply chain shortage days of 2002, but the short term trend is more of the same, having established a bottom and should trade within a range between 0% and 2%, below the long term average of 2.6%. Inflation should return to its long term average; however, interest rates will come down very slowly since demand is still strong.

The longer inflation maintains its historical average, the faster long term interest rates will fall, because of the reduced premium as a hedge against rising inflation. Long term rates will not reach the pandemic caused lows but should reach equilibrium around 5%. Keep an eye on the Producer Price Index to know for sure.

For more articles on inflation and the Consumer Price Index, check out our article: The Critical Item In Your Lease Is Not The Rate But The CPI