An estimated $532 billion in mortgages on commercial property comes due in 2024, and since most commercial property loans are made by local and regional banks, the potential damage for commercial property defaults could bring about the same problems we saw in the 2008 crisis which sent the economy off a cliff. Last year's bank victims were Signature Bank which held a 12% market share of New York City commercial property, and Silicon Valley Bank which was the 2nd largest bank failure in U.S. history. This article explores delinquency rates among the major sectors and examines which commercial property sectors are safer than others.

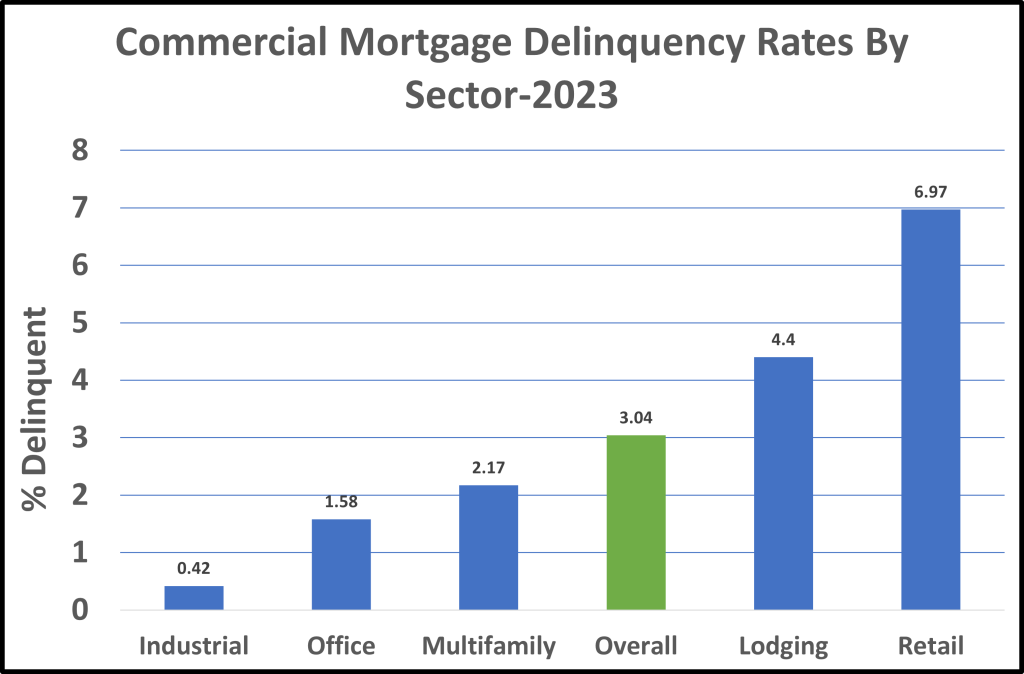

The overall delinquency rate for 2023 was 3.04% which does not seem high but amounts to $16 billion of the commercial mortgages due to mature in 2024. The risk to an average person is if a bank has a high percentage of commercial loans, any defaults could affect the banking industry but also the economy. New Orleans' FNBC bank failure was only $1 billion but was Louisiana's largest bank collapse.

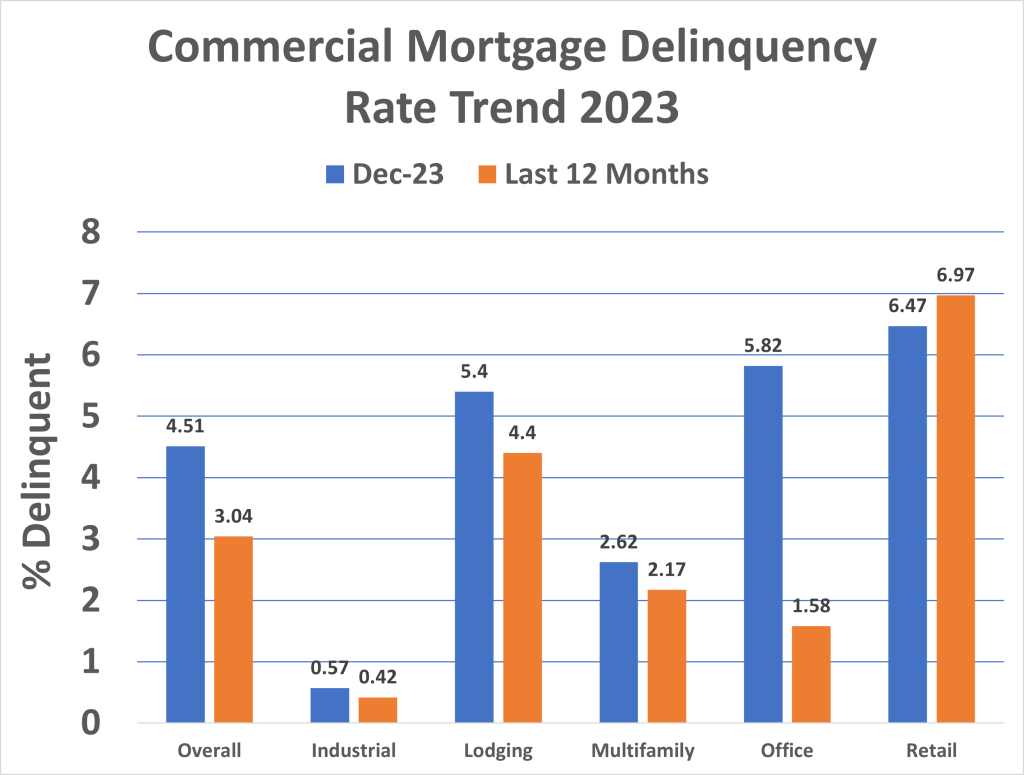

Note in the chart above how little the industrial sector is affected by delinquent loans, compared to all the other sectors. The explanation is that an industrial plant is not feasible to relocate and is less susceptible to market changes like the lodging and office sectors are. The most vulnerable sector is still retail, which has double the overall delinquency rate, but was the only sector to get better in December compared to the last 12 months. It is no surprise that the office sector is worse, with December's delinquency almost three times its 2023 average.

When a commercial loan gets into trouble, most banks will simply extend the loan and add on additional principal payments. The result is that the owner gets to fix things if the cycle reverses and keep the property but will give up equity. While non-performing loans are monitored by the Federal Reserve Bank, especially those over 90 days, the banks have an incentive to extend a loan rather than take over the property. This just throws good money after bad and we can only say a prayer when delinquent mortgage judgement day comes.

For more information on commercial property trends, read our article Commercial Property Prices By Sector in Louisiana Major Cities.