This is the kitchen sink article: we look at all the commercial sectors across the state of Louisiana to examine current asking and actual prices and size of the market, then we drill down into the office sector in the major cities to determine trends in prices and supply since 2011. Let’s get started.

First, let’s look at Louisiana. The total market value for all commercial property sectors, for sale and for lease, is $5.1 billion, with only $367 million for lease and $4.78 billion for sale, but the data uncovers two surprises: one, that 60% of the dollar value is in the vacant land sector and, on top of that, the driving force of the New Orleans economy-the hospitality sector-has the smallest market share of 1.67%.

Even though we are examining last month’s activity for the entire state, each sector is driven by its own supply and demand. For example, the industrial sector lease prices are the most stable, with the average asking price for lease across the state at $4.90 per square foot and the actual price leased at $4.89 per square foot for the 10 spaces leased last month of the 287 properties on the market.

The office sector failed to get its Covid shots and is still sick, with average asking prices of $18 per square foot but landlords, so anxious to find any tenant, were willing to settle for $16.10 per square foot for the 60 spaces leased of the 2,406 on the market.

The retail sector averaged lease rates of $18.23 per square foot, 18% higher than the average asking price of $15.50, for the 34 spaces leased of the 1,079 on the market. The explanation is that the higher priced retail stores are in better locations and the only ones in demand.

The shopping center sector averaged actual lease rates of $21.98 per square foot, an increase of 53% over the average asking lease rate. There were only 15 lease transactions of the 655 listed, so the large variance in actual prices means that the well-maintained, best location, shopping centers were the ones attracting tenants.

This week we drill down into the office market in Louisiana where there are 2,406 lease listings, approximately 20% more than the 2,162 average since 2011. The average lease listing since 2011 is 3,900 square feet with an asking lease rate of $16.35 but actually leased at $14.35 per square foot. Asking lease rates are at their highest levels with the July 2023 average asking lease price at $18 per square foot, up 9% from $16.50 per square foot in January 2021. The increase in rates was produced by a supply of office space that peaked at 11,500,000 square feet in December 2017 and declined 26% to 8,500,000 square feet as of July 2023. These numbers are for the state as a whole, but each city has a different dynamic.

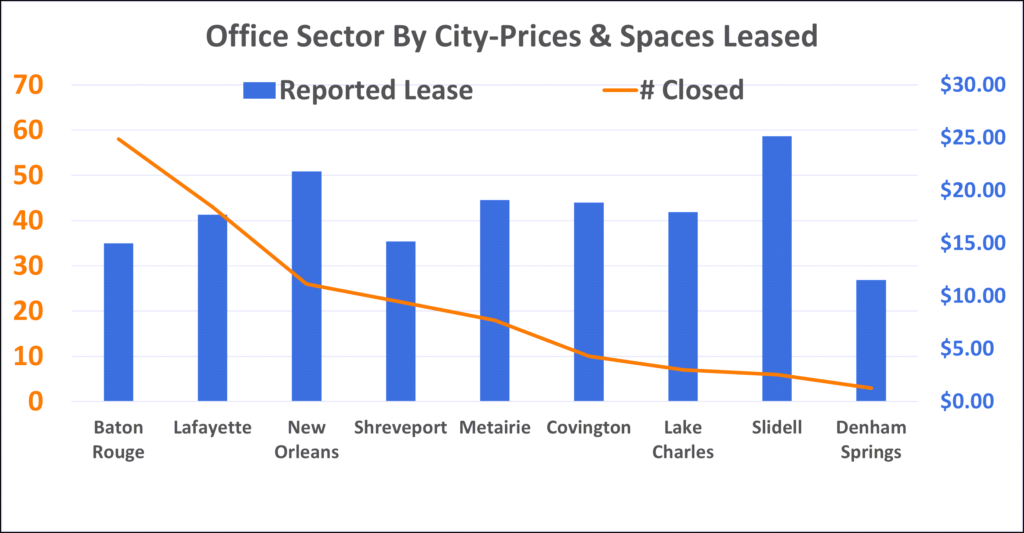

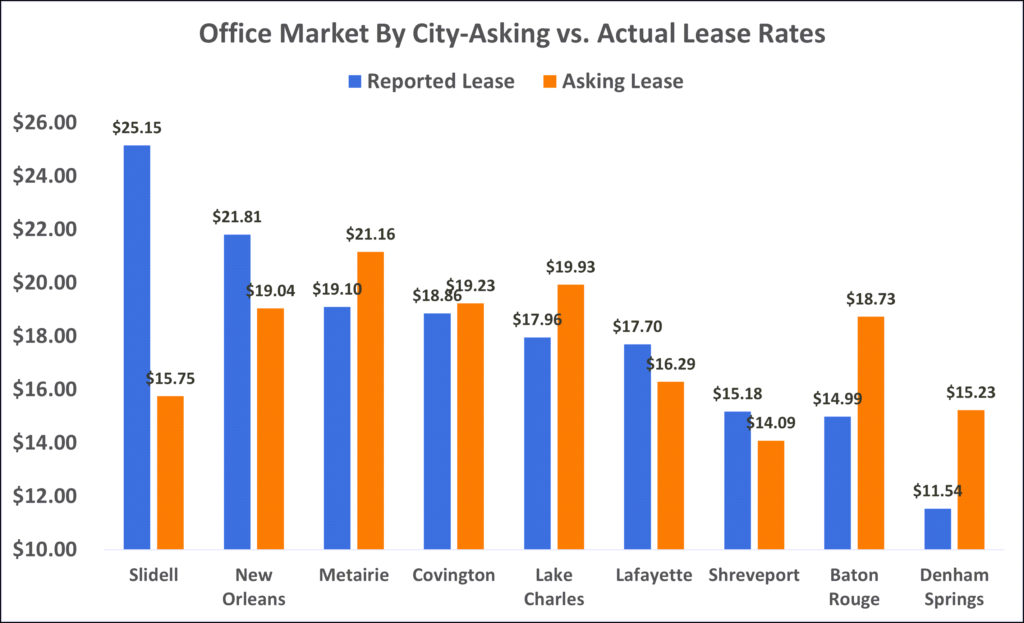

Drilling down into the office sector for the last 3 months, Baton Rouge and Lafayette accounted for 52% of all office lease transactions. Baton Rouge averaged only 2nd to last in prices however, with an average lease rate of $14.99 which was a 20% discount to asking lease rates. There were 58 office spaces leased the last 3 months in Baton Rouge, of the 1,872 on the market.

The Slidell office market has proven to be the strongest, with the highest lease rates averaging $25.15 per square foot for the 6 spaces leased of the 152 listed. Asking prices average $15.75, so the highest quality office spaces at the top of the price range were the spaces tenants wanted.

The commercial market in Louisiana is not homogeneous by sector nor by city. Prices as of July 2023 show that the industrial market is stable, the office market has the highest lease prices of all time but deals are done at a 20% discount, the retail sector is strong with actual lease rates higher that the overall asking rates, and the shopping center sector last month had 15 transactions at a 53% premium to the average lease price. Slidell reported the highest office lease prices but Baton Rouge scored the most spaces leased because prices were discounted 20%.

For more information on prices, catch our blog on New Orleans prices by sector-May 2023.

Hard data from LACDB, Loopnet/CoStar & Crexi.