The most important unknown in valuing commercial real estate is the Cap Rate, which is the multiple applied to income from property to determine market price. Cap Rates vary by city, state and sector but are also influenced by rates of returns in other investments such as US Treasury Bonds. This article drills down into Cap Rates for the US, and highlights Louisiana and Mississippi Cap Rates for all the major sectors: Office, Industrial, Hospitality, Retail and Multifamily.

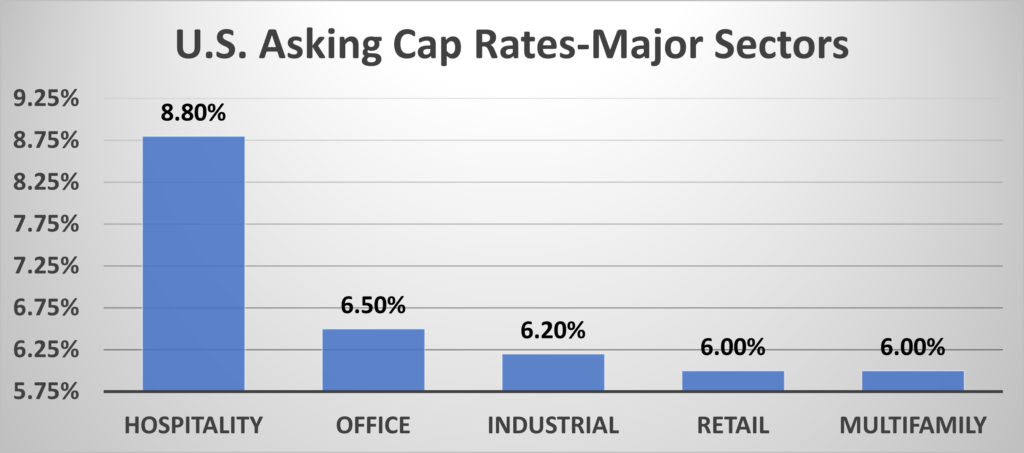

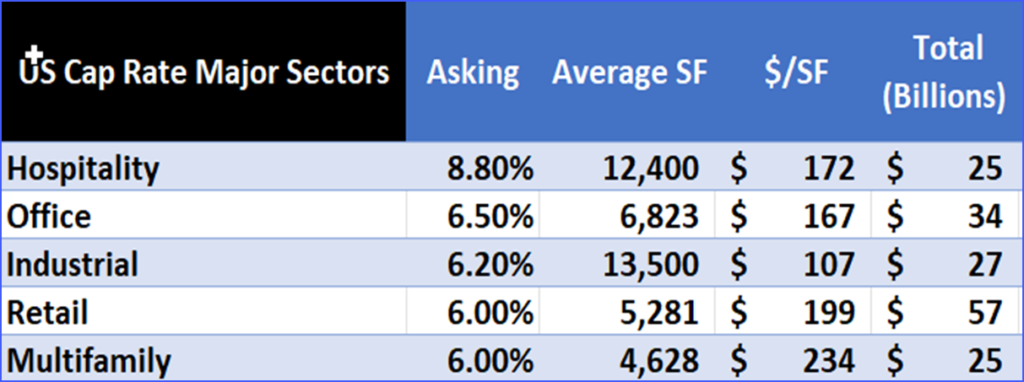

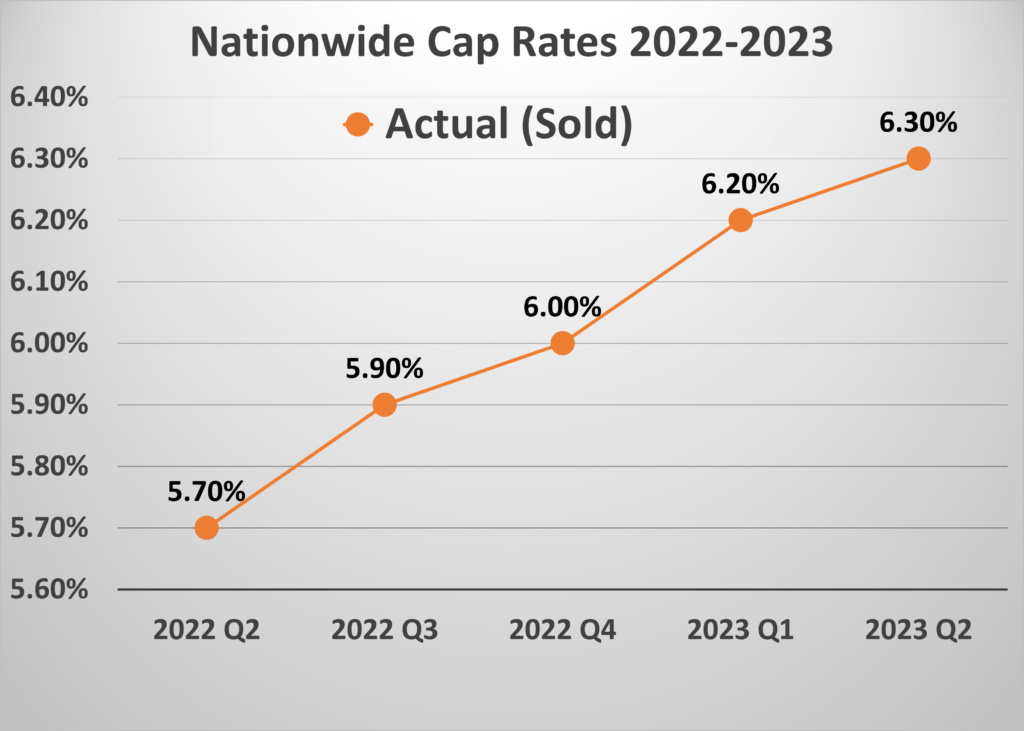

First, let’s summarize the national markets and then drill down into each sector in Louisiana and Mississippi. Nationwide, we examined 176,120 properties totaling $959 billion, which provides a large enough population of data so the results can be statistically significant. The data show that the average property is priced at $175 per square foot and was on the market 158 days with an average asking Cap Rate of 6.1% but the actual sale Cap Rate was 6.3%, which means that the property sold at a slight discount to asking price. The asking Cap Rate ranged between 6% and 6.5% except for an outlier in the Hospitality sector where the nationwide asking Cap Rate was 8.8%. The explanation is that in the Hospitality sector, 40% of the properties are smaller properties valued under $1,000,000 and listed at higher Cap Rates.

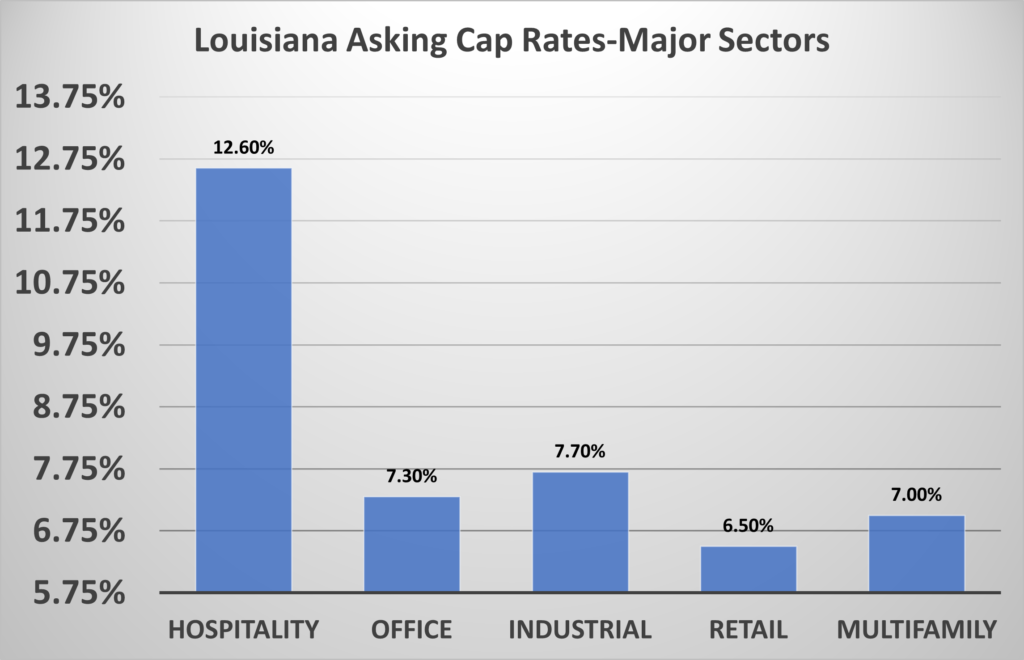

Louisiana asking Cap Rates average 7%, with 4.2 billion in property averaging $113 per square foot for 8,000 SF. The Hospitality sector has an asking 12.6% Cap Rate because over 50% of the properties are priced under $1,000,000.

These lower priced properties tend to be in less demand but the averages are offset by the 10% of Hospitality properties priced over $6,000,000 which are more in demand. Asking Cap Rates on Industrial are 7.7% and Retail is back in strong demand at a 6.5% asking Cap Rate.

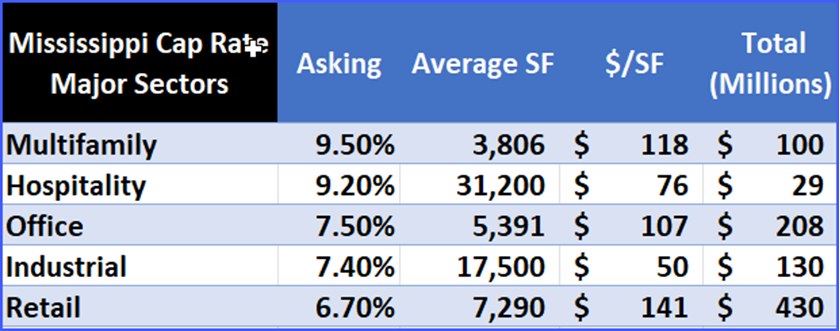

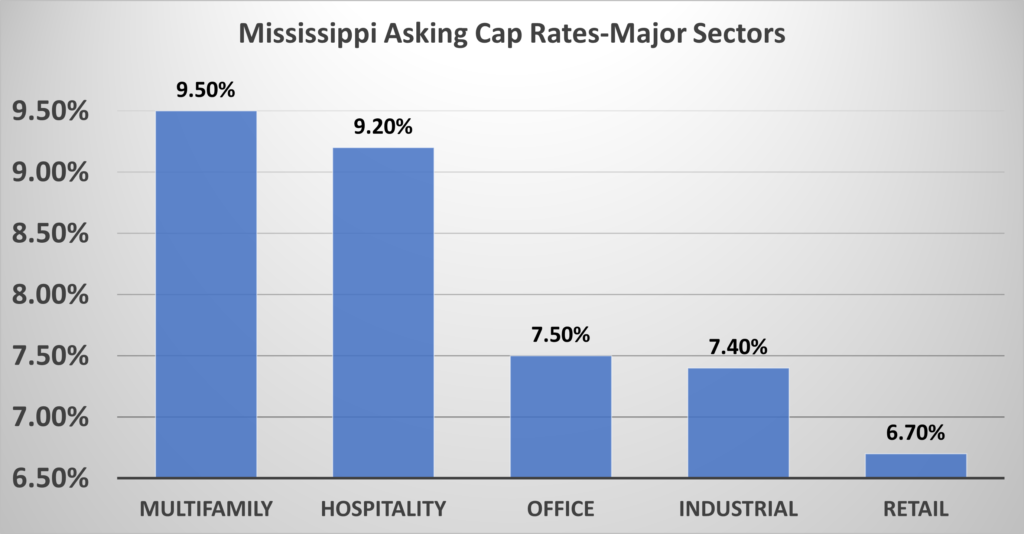

Mississippi asking Cap Rates average 6.8% with 2 billion in 3,072 properties averaging 7,790 square feet for $105 per square foot. The Multifamily sector averages a 9.5% asking Cap Rate with over 75% priced under $1,500,000 which can carry a higher Cap Rate that raises the average.

The Hospitality sector also stands out with an average asking Cap Rate of 9.20% because over 80% of the properties are priced under $1,200,000. Industrial asking Cap Rates are 7.4% but Retail is back in strong demand at a 6.7% Cap Rate.

Nationwide, actual sold Cap Rates over the last 12 months increased from 5.7% to an ending June 2023 of 6.3%. While this increase in Cap Rates seems small, the effect on the market price of the asset can be dramatic because any change in asset value can trigger loan parameters that a bank may have on a property. In a worse case future scenario, a bank may require the owner to come up with additional money on a loan, so that the loan to value ratio is unchanged. For example, the Cap Rate change just these past 12 months from 5.7% to 6.3% means that for every $10,000 in net operating income, the value of the asset would have fallen $16,700.

The Louisiana market followed the national average these last 12 months, with the Hospitality sector having a much higher asking Cap Rate of 12.6% due to a large number of lower priced properties. Overall, the Louisiana asking Cap Rate increased from 6.5% to 7%.

The Mississippi Cap Rates were unusual in that both the Hospitality and Multifamily sectors had asking Cap Rates over 9%. While overall asking Cap Rates over the last 12 months ranged from 6.9% to 7.4%, now the average is 6.8%.

Want more information on using Cap Rates to value commercial property, rather than articles on recipes? Check out our blog: How To Value Real Estate Using Cap Rate.

Hard data is from Crexi, LACDB and LoopNet/CoStar.