Your lease always has language that describes how the rent you pay can be adjusted using the Consumer Price Index, meaning your rent payments increase at the end of each year because the rent rate you paid last year is multiplied by the index to determine the rent you pay in the next year.

The problem is that there is more than one Consumer Price Index and there are different ways to calculate each, so make sure your lease agreement contains language that is very specific. Most leases refer to the All Urban Consumers Price Index, but here are all four CPI databases:

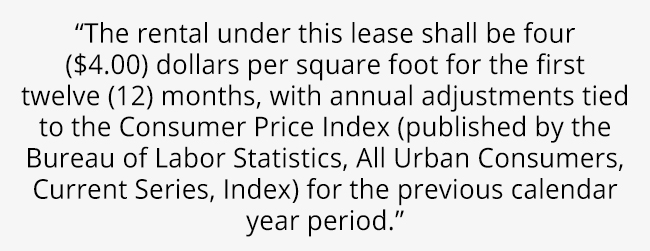

The idea got its start in the 1970's when inflation was 20 percent and is meant to benefit only the landlord because it means the rental income to the landlord retains its purchasing power. One example of lease language referencing the CPI is:

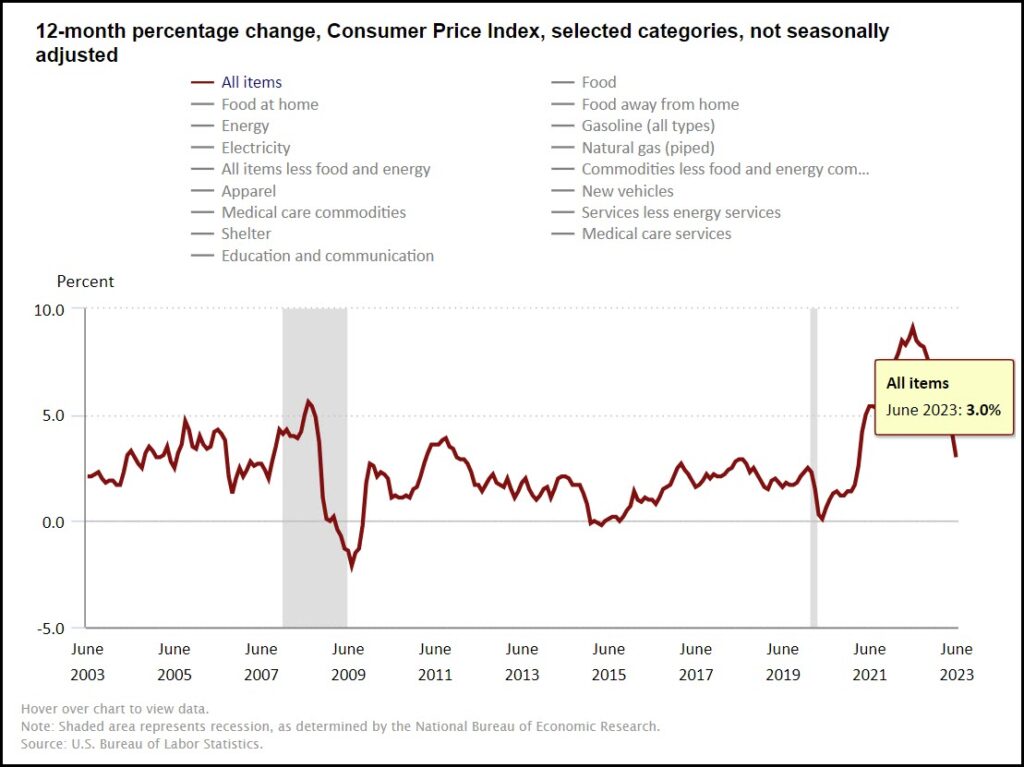

So what is the Consumer Price Index and how is it calculated? The Bureau of Labor Statistics, under the Department of Labor, calculates the latest Consumer Price Index numbers. The CPIs are based on prices of food, clothing, shelter, fuels, transportation, doctors' and dentists' services, drugs, and other goods and services that people buy for day-to-day living. Prices are collected each month in 75 urban areas across the country from about 6,000 housing units and approximately 22,000 retail establishments (department stores, supermarkets, hospitals, filling stations, and other types of stores and service establishments).

The All Urban Consumers Price Index consists of all urban households in Metropolitan Statistical Areas (MSAs) and in urban places of 2,500 inhabitants or more. It represents about 93 percent of the total U.S. population. Nonfarm consumers living in rural areas within MSAs are included, but the index excludes rural nonmetropolitan consumers and the military and institutional population.

In calculating the CPI, the urban portion of the United States is divided into 38 geographic areas called index areas, and the set of all goods and services purchased by consumers is divided into 211 categories called item strata. This results in 8,018 (38 × 211) combinations.

The CPI represents all goods and services purchased for consumption by the reference population with all expenditure items divided into 211 categories, arranged into eight major groups:

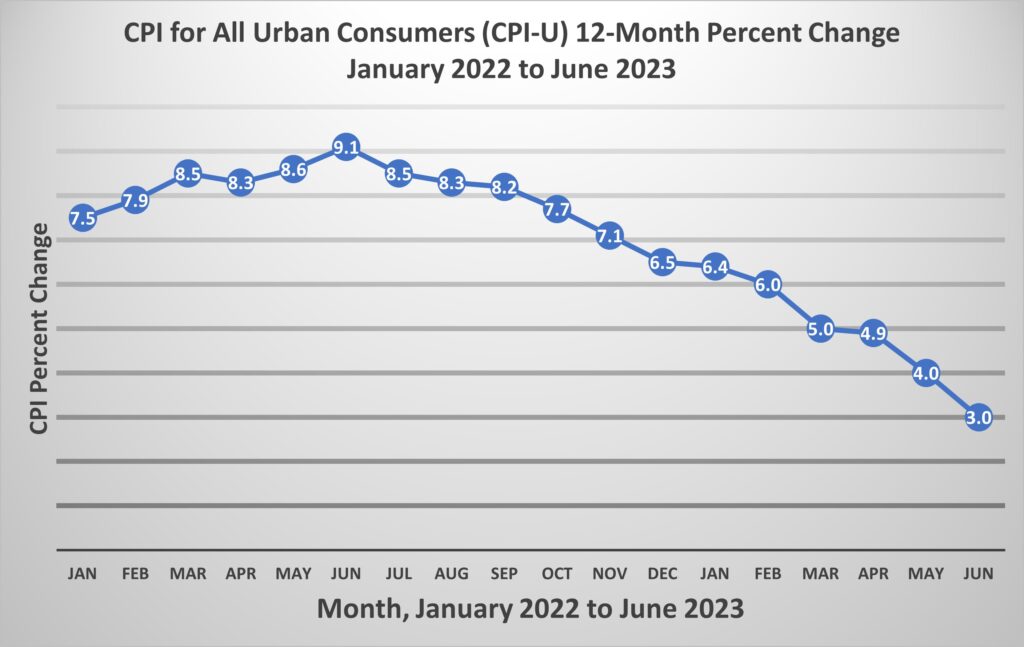

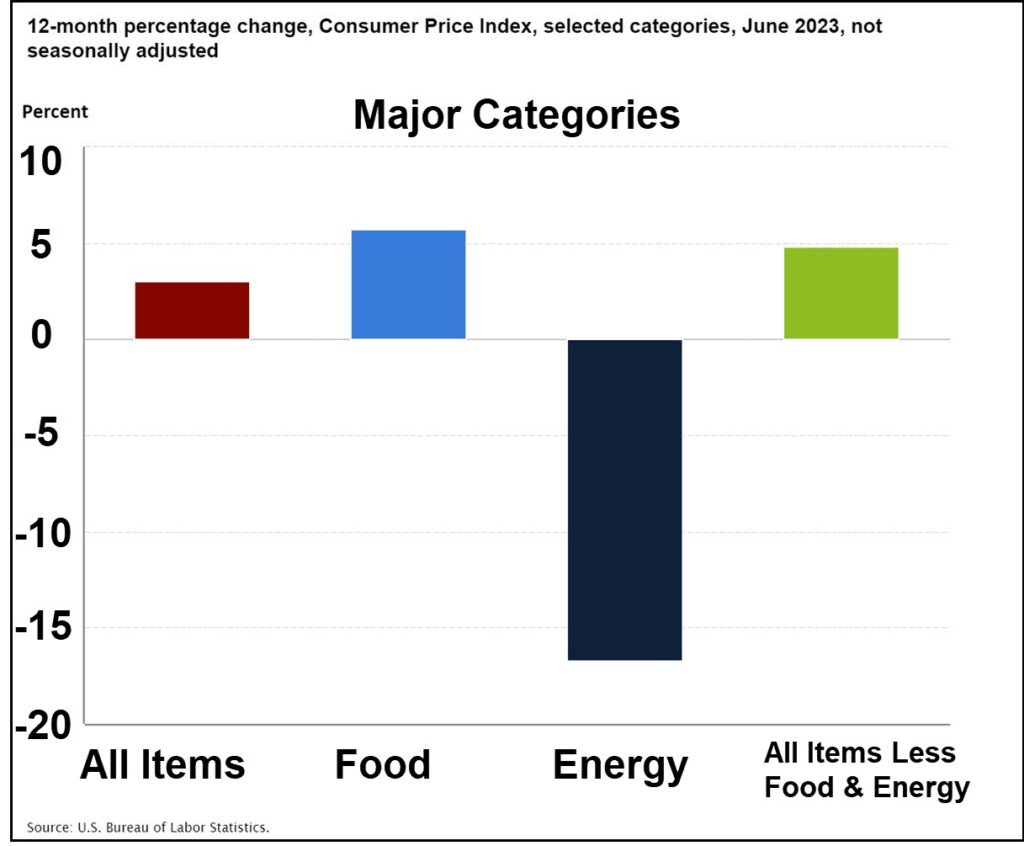

For the month of June 2023, the All Urban CPI rose 2/10ths of one percent and over the last 12 months increased 3.0 percent before any seasonal adjustments. This was the smallest 12-month increase since the period ending March 2021 and while some categories increased in price, others dramatically decreased. For example, the cost of shelter accounted for 70 percent of this increase because prices were 7.8 percent higher, but there was a major decline in the energy index which plummeted 16.7 percent.

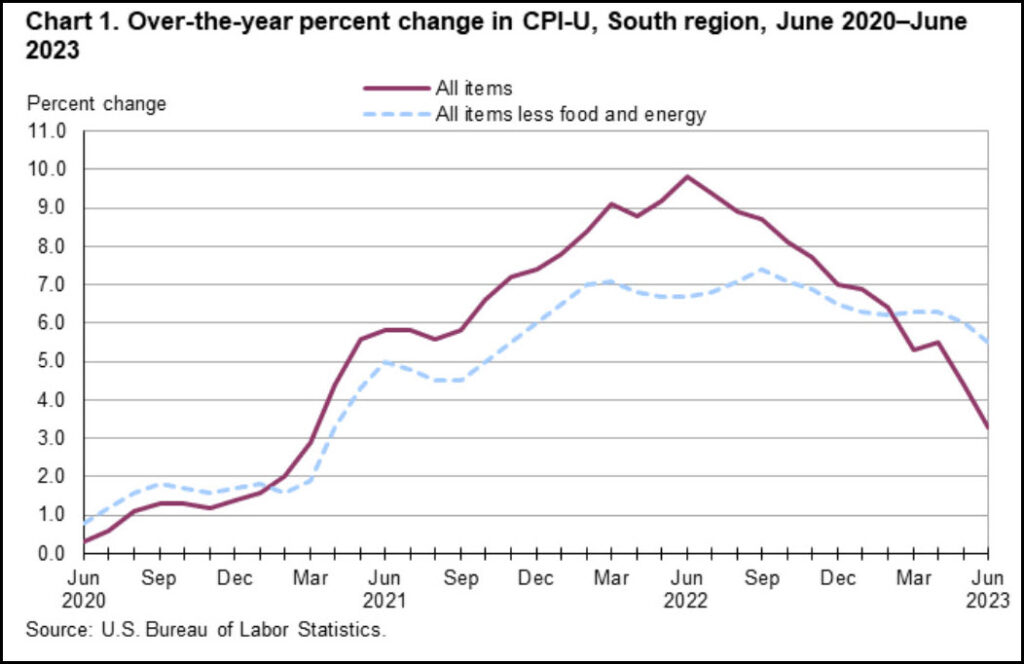

The CPI is calculated for the U.S. as a whole but additional data is calculated for each state and also for each of the 7 regions. Louisiana specific data falls into the Southwest Region and Mississippi specific data falls into the Southeast Region. Above is the chart of CPI for the South Region which is comprised of Alabama, Arkansas, Delaware, District of Columbia, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia, and West Virginia. If you wanted your lease to more accurately reflect the CPI in your region, you would substitute these region numbers for the U.S. CPI numbers. For example, the 12 month South CPI rose 3.3 percent for the 12 months ending June 2023 compared to the U.S. number of 3 percent.

For more information on leases, read our blog "3 Common Mistakes In Every Lease".