If you rent space for your business, your lease probably has a clause that makes your rent increase as inflation increases, so be ready to automatically pay a lot more in rent. This article explains how inflation in your lease language is calculated and how to know ahead of time how your rent could increase.

Your lease should have a detailed explanation of how your rent increases with inflation, and lease language always includes these trigger words:

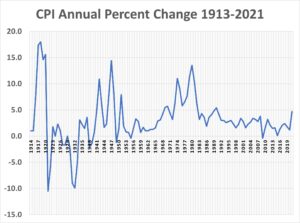

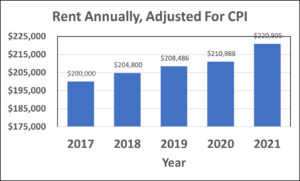

For example, let's say your initial lease term is 5 years and your rent for 10,000 square feet is $20 per square foot per year, adjusted annually for the CPI. Those annual rent adjustments total $45,000, even though the CPI the last 5 years only ranged from 1.2% to last year's high of 4.7%, as shown in the table and chart below. Had you negotiated for a 5 year initial term with a CPI adjustment at the end of the 5 years, rather than annual adjustments, you would have saved $45,000.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services, and most leases should use the CPI All Urban Consumer group which represents about 93 percent of the total U.S. population. It is based on the expenditures of almost all residents of urban or metropolitan areas, including professionals, the self -employed, the poor, the unemployed, and retired people, as well as urban wage earners and clerical workers. Prices are collected each month in 75 urban areas across the country from about 6,000 homes and approximately 22,000 retail establishments (department stores, supermarkets, hospitals, filling stations, and other types of stores and service establishments).

Before these items are purchased by consumers, they are produced by manufacturers, and their change in price is tracked by the Producer Price Index, which includes over 100,000 items. The Producer Price Index (PPI) measures the average change over time in the selling prices received by domestic producers for their output, and you can use the PPI to forecast the CPI and your increase in rent.

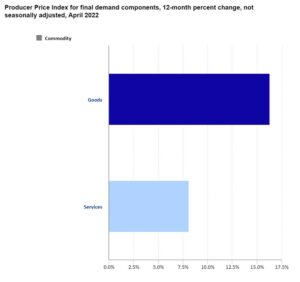

The Bureau of Labor just announced the Producer Price Index increased 11.0 percent from April 2021 to April 2022. The Index is comprised of both goods and services, with producer prices for goods increasing more at 16.3 percent, while prices for services increased 8.1 percent, as shown in the chart below.

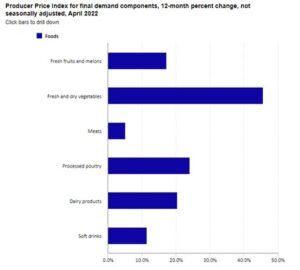

Not all categories increased prices the same, however. Producer prices of goods can be further subcategorized into Foods, Energy and Other, with each component incurring a wide range of price increases. Energy prices topped the list, with gasoline and auto prices increasing 50% over the last 12 months.

The food category can be further subcategorized: vegetables increased 45% but meats increased only 5%. Health and Beauty items only increased 1.4% while securities brokerage and portfolio management prices declined.

The energy category can also be subdivided, as in the chart below showing jet fuel prices increasing 127% and diesel prices increasing 86%, while electric power prices only increased 10%.

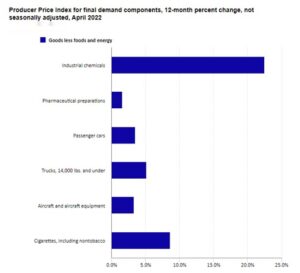

In the Other category, Goods Less Food and Energy, the largest price increase was in the Industrial Chemicals subcategory with price increases of 22% while pharmaceuticals only increased 1.6%.

In summary, follow these subcategories of the Producer Price Index to give you an idea of where the Consumer Price Index is going and use this information to negotiate better lease terms for your business. Remember, a lease is an agreement between you and your landlord and can always be amended if you have accurate information and facts to show how it is in the landlord's and tenant's best interest.

For more information on how inflation affects commercial leases, read our articles: