Whether you rent office space, a warehouse, or a retail store, your lease probably has language that ties rent you pay to the Consumer Price Index. The idea is meant to benefit only the landlord, because the rental income retains its purchasing power. The problem is that there is more than one Consumer Price Index and there are different ways to calculate each, so make sure your lease agreement contains language that is very specific. One example of lease language referencing the CPI is:

Whether you rent office space, a warehouse, or a retail store, your lease probably has language that ties rent you pay to the Consumer Price Index. The idea is meant to benefit only the landlord, because the rental income retains its purchasing power. The problem is that there is more than one Consumer Price Index and there are different ways to calculate each, so make sure your lease agreement contains language that is very specific. One example of lease language referencing the CPI is:

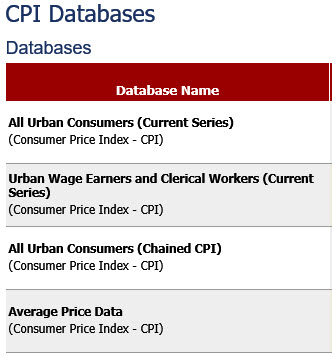

The rental under this lease shall be four ($4.00) dollars per square foot for the first twelve (12) months, with annual adjustments tied to the Consumer Price Index (published by the Bureau of Labor Statistics, All Urban Consumers, Current Series, Index) for the previous calendar year period.

Calculated for specific items such as, household fuel, motor fuel, and food items from prices collected for the Consumer Price Index (CPI). Average prices are best used to measure the price level in a particular month, not to measure price change over time.

Calculated for specific items such as, household fuel, motor fuel, and food items from prices collected for the Consumer Price Index (CPI). Average prices are best used to measure the price level in a particular month, not to measure price change over time.In calculating the CPI, the urban portion of the United States is divided into 38 geographic areas called index areas, and the set of all goods and services purchased by consumers is divided into 211 categories called item strata. This results in 8,018 (38 × 211) combinations.

The CPI is calculated in two stages. The first stage is the calculation of basic indexes, which show the average price change of the items within each of the 8,018 CPI item-area combinations. At the second stage, aggregate indexes are produced by averaging across subsets of the 8,018 CPI item–area combinations.

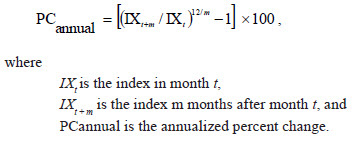

Percent changes for periods other than 1 year often are expressed as annualized percentages. Annualized percent changes indicate what the change would be if the CPI continued to change at the same rate each month over a 12-month period. These are calculated using the standard formula for compound growth:

The CPI represents all goods and services purchased for consumption by the reference population with all expenditure items divided into more than 200 categories, arranged into eight major groups. Major groups and examples of categories in each are as follows:

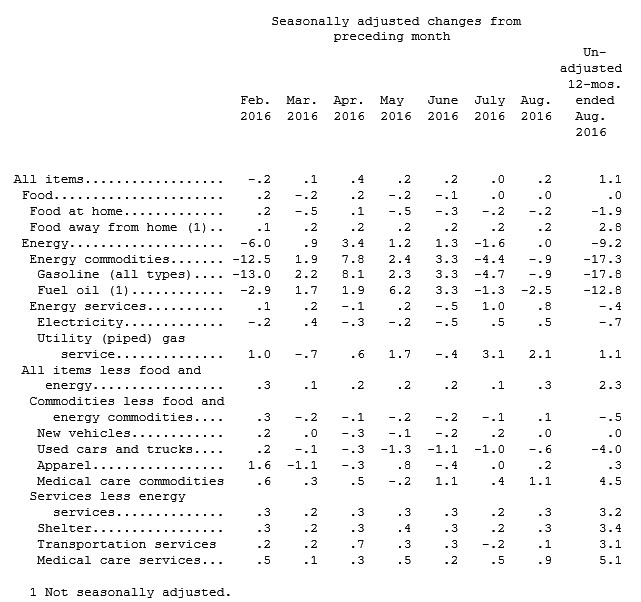

The Bureau of Labor Statistics, under the Department of Labor, released the latest Consumer Price Index numbers yesterday, using the All Urban Consumers Index which increased 0.2 percent in August, but this was for only one month and it was not seasonally adjusted. The seasonally adjusted number increased 0.3 percent, the largest increase in 6 months, due to increases for shelter and medical care.

Some August prices increased while others decreased, which is why the CPI can be misleading. The indexes increased for motor vehicle insurance, apparel, communication, and tobacco; however, the indexes decreased for used cars and trucks, household furnishings and operations, recreation, and airline fares.

These numbers are only for the month of August, and leases should use the annual number. The all items index rose 1.1 percent for the 12 months ending August. The index for all items less food and energy rose 2.3 percent for the 12 months ending August. The food index was unchanged over the last year while the energy index declined 9.2 percent.

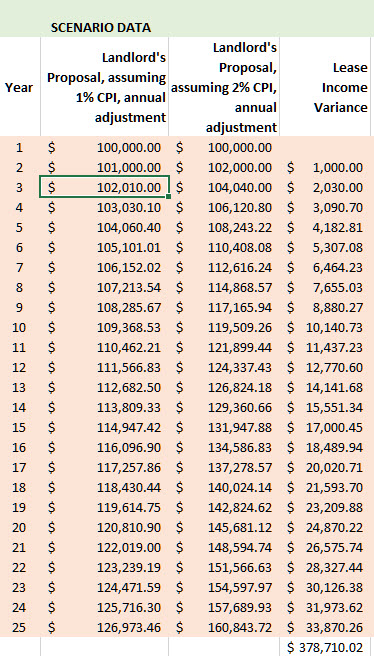

Inflation is not what it used to be. In the 1980's the CPI approached 20% and the greatest economist alive said it was going to 25%. It went to 2%. Our economy today is driven by a different wage/price spiral and low inflation helps borrowers and hurts landlords and savers. Building in a CPI adjustment can still make a difference in a long term lease, as shown in the table below which compares a 1 percent CPI to a 2 percent CPI adjustment over a 25 year time frame. A 1 percent incremental rate increase annually results in $378,000 additional income over the 25 year span, and assuming a 10 percent Capitalization Rate, increases the market value of the property $338,000, or 33%.

Summary

In leasing any type of property, whether you are the landlord or the tenant, make sure your lease is clear about what the rent is, and what inflation adjustments apply to the rent. Any lease document can be revised, even though some parties say they use a standard lease. There is no such thing. A lease is an agreement between two parties, and you should revise it to include language that works for you. As always, consult an expert.

Free Lease Consultation: If you have questions about a lease document, Louisiana Commercial Realty offers a free lease review, which includes an analysis of nearby rental market prices.