Money is made in commercial real estate by having the vision to create value where none existed before. Since commercial property prices are not transparent like stocks quoted at the bottom of your screen TV, the person who accurately determines value is the one who comes out ahead. Smart commercial real estate investors use a tool called the Capitalization Rate, or Cap Rate, and this article shares the basics and how you can use it to your advantage.

Whether you are investing in stocks or bonds or real estate or certificates of deposit, you do so to realize a greater value in the future, which is determined by two inputs: cash flow and appreciation. With stocks, you might get a dividend and hopefully capital gain, and with CD's you get income and no gain- just your principal back, and with bonds you get interest, or cash flow, and principal back at maturity and maybe a gain or loss if the value of the bond trades higher or lower before maturity. With commercial real estate, you also get rental income and maybe appreciation when you sell.

The smart way to value all of these investments is to calculate the present value of the cash flows. That is, what you would pay today for the future income generated by the investment. If you expect to receive $100 one year from now, how much would you pay for that investment today? First, you have to know your opportunity cost, or how much interest you would earn on your next best opportunity.

Let's say you could earn 3% in a CD for one year, then comparing that to an alternative investment for one year that would pay $100, you would divide the $100 by one plus the interest rate (1 +3%), or 1.03, which is the same as $100/1.03 which equals $97.08. Therefore, you would pay $97.08 today for $100 in one year.

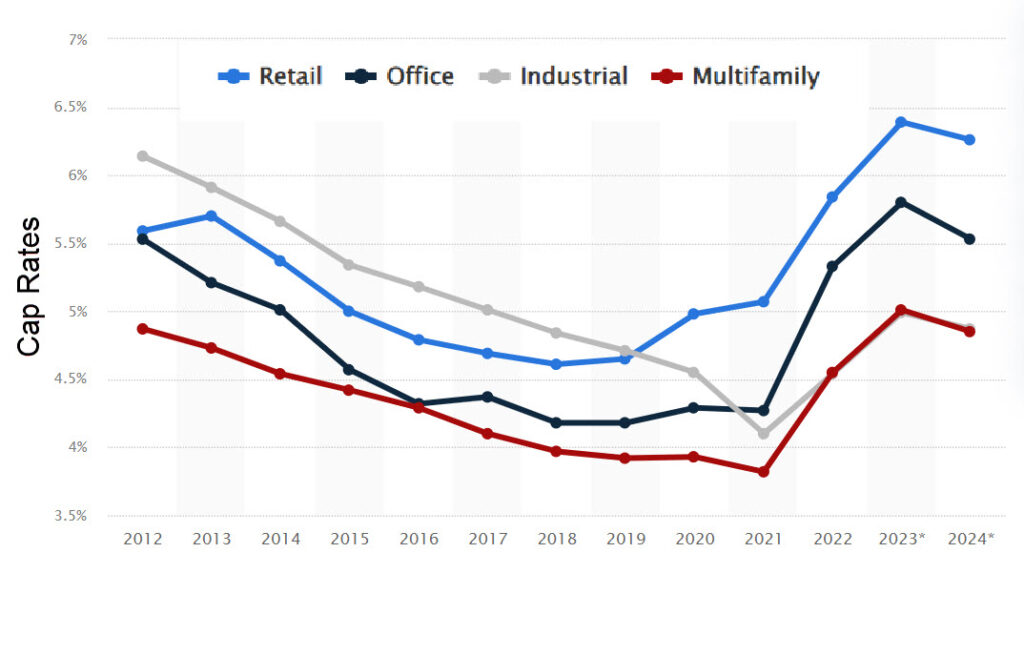

To value commercial real estate, you use a variation of the same principal. You start with the calculation of the Net Operating Income, which is Gross Income less Operating Expenses, including vacancy and credit losses but not depreciation. You determine value for commercial real estate by dividing the Net Operating Income by the Cap Rate, which can vary by region and by category of real estate, and below is a chart showing the history of average Cap Rates.

The chart shows Cap Rates average 5.4 percent. The way you use this is the following: divide your Net Operating Income by the Cap Rate, and the result is the value. Let's say you have a commercial property that produces $1,000,000 in Net Operating Income, and you then divide that by the Cap Rate: ($1,000,000/5.4%=$18,518,518). Therefore, you would pay $18,518,518 for the property. This assumes no increase in value due to appreciation, but you use the same strategy to calculate an additional appreciation (as an investor though, you don't pay other people for appreciation which you create). A small change in Cap Rate makes a big difference in value, so this tool is important in valuing commercial real estate.

For more information on valuing commercial real estate, you can get workshops on Commercial Real Estate Financial Analysis at CCIM.